You're OK. Your kids are OK. You have much to be thankful for.

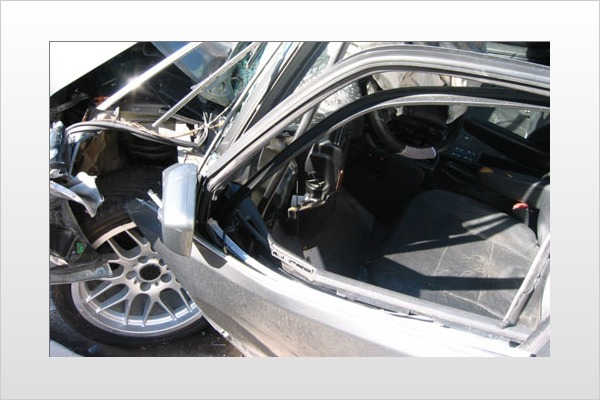

As for your car, well, there's not a lot left. The last time you saw it, it was being hoisted heavenward with two limp, deflated airbags dangling from the dashboard and broken glass littering the footwells. The front-end sheet metal resembled a rice-paper lampshade after a cross-country move. Questions start filling your head. Will you ever see it again? Should you start looking for a replacement? And at this point in time, is your auto insurance company a friend or foe? What if your car is rare or collectible? The following step-by-step guide helps answer these questions and more to help you survive the scrutiny of your car insurance company after you've survived a serious accident.

Step 1: Brush up on your car insurance policy, before an accident occurs.

Most of us know generally what kind of car insurance coverage we have — liability, comprehensive and collision, for instance. However, when it comes to the fine print, there are terms about which most of us have absolutely no clue (but that are sure to surface when it comes time for your insurer to shell out cash to repair or replace your damaged vehicle). So in order to make sure you are dealt a fair hand when the dust settles, sit down with your agent and learn what those big terms in the small font really mean. We advise doing this before a serious accident occurs, particularly since insurance agents tend to be far more pleasant to deal with when they're not in the middle of a messy claim.

If, however, you're reading this in the aftermath of a bad accident, it's crucial that you understand what you're entitled to moving forward. So when you're done reading this article, bite the bullet and talk to your agent about exactly what your policy covers (not just in relation to this accident, but everything else, too). And bring cookies.

Step 2: Get moving again.

If you have rental car coverage, rent the best car your coverage allows and get moving again. Having a rental car will at least help keep the rest of your life from falling apart while you get this matter settled. Depending on your coverage, you may not get as nice a rental as what you actually own, but at least you won't be stranded at home or burdening your friends and neighbors for rides while you deal with repairing or replacing your car.

Talk to your agent before you rent a vehicle, because you may still be liable for collision damage to the rental car as well. Policies vary in the way they cover this, so check the language of your policy before renting a car.

Step 3: Check your state's department of insurance for a list of your rights as an insured driver.

Every state regulates its car insurance companies to some degree in order to protect its citizens from being shortchanged or cheated after filing a claim. Some states are more closely involved with this process than others, so log on to your state's governmental Web site and search for its department of insurance to find more information regarding the fair settlement of insurance claims. You will often find a bounty of helpful information that will guide you as you move forward in this arduous task.

Step 4: Find out how much your car was worth before the accident.

Claims adjustors from your car insurance company use a combination of dealer surveys, value guide books, online pricing sites and actual private party sales to determine your car's actual cash value (ACV). They also factor in things like sales tax, registration and title costs of a replacement vehicle to determine this amount. Proprietary as they are, these determinants can vary from company to company and state to state. Ultimately, then, what one company comes up with may not match what another may find, or even what you'll come up with on your own, using consumer Web sites like Edmunds.com.

A bit of advice, then: don't just take their word for your car's ACV. Involve yourself in the evaluation process. Do some research on your own, because the higher your car's ACV, the bigger your check is going to be if they determine it's been totaled. A valuable tool for establishing the worth of your car is Edmunds' True Market Value Appraiser. The appraiser will adjust to price based on condition level, region, mileage and options. In some instances, such as if you have a particularly rare trim level, color combination or special edition of a vehicle, you may know without a doubt that your car is worth more than what the insurance company tells you. Don't be afraid to present your case and ask them to make an adjustment — if your argument is sound, companies will probably listen to you. In fact, your insurer is required by law to give you a fair price, and they won't want to fight you in court if it looks like you could win. But you may have to do the extra legwork of finding an independent appraiser and/or compiling research on your specific car to bolster your case.

Step 5: Agree upon a fair evaluation of the damage.

Auto insurance companies must do a visual evaluation of the damage to your vehicle to begin estimating the cost of repairs. It helps to be there with them when they survey the damage, so that you can point out anything they may overlook. Make sure that they see all damage in order to ensure a proper settlement.

Keep in mind, however, that the more damage they see, the more likely it is that your car will be declared a "total loss." Here's where it gets hairy, since, depending on how much you love or hate your car, the concept of total loss can be a bad or good thing. First, a definition of the term "total loss."

According to the Insurance Consumer Advocacy Network (I-CAN), a self-help Web site for consumers run by a former insurance adjustor, insurance companies define a "total loss" as:

"The cost of repair plus projected supplements plus projected diminished resale value plus rental reimbursement expense exceeds the cost of buying the damaged vehicle at its preaccident value, minus the proceeds of selling the damaged vehicle for salvage."

Huh? Simply stated, if compensating you for repairing the car, renting something in the meantime and paying you what your car has lost in value costs more than what they'd shell out to just buy you a replacement and then sell your wreck to a salvage yard, you're not going to get your car back, but a check instead.

If the estimate your insurer comes up with is questionable to you, check your policy for an "Appraisal Provision" that would allow you to get an independent appraisal of the damage, which would then be reviewed by an "umpire" jointly selected by your appraiser and that of your auto insurance company. If the two appraisers can't agree on an amount of your car's ACV and damage, the umpire steps in, basically to take one side or the other to help resolve the issue. While you have to pay for your appraiser, and share the umpire's fee, it may be worth the expense if you really feel that your auto insurance company is trying to give you short shrift.

However, given the sizable expense of fixing a damaged car, compensating you for lost resale value, rental car costs and so on, it's easy to understand why insurance companies often throw up their hands long before the repair bill exceeds the car's ACV. For example, some companies consider a wrecked vehicle a total loss when the total cost to repair it exceeds just 51 percent of the vehicle's ACV. Others don't give up until the repair bill hits the 80-percent mark.

This explains how a company can send an older car to the scrap yard after a minor fender bender, then turn around and call for a very damaged late-model vehicle to undergo extensive surgery. It can be helpful to know beforehand how your company deals with this kind of thing, even though it may not change the outcome of a claim in the long run. This way, at least you're not in for a shock when they come back and tell you ol' Bessie the Buick's not coming home. Also, be sure to ask how your auto insurance company deals with any aftermarket additions, such as custom wheels, that you may have installed on your car.

Step 6: Decide if you want the car back.

After a really serious accident, many people are inclined to go ahead and find a comparable replacement (or even take the opportunity to upgrade to a nicer car) rather than get their car fixed, since repairs sometimes cannot return it to its original quality. And even if a car can be repaired to "like new" condition, it will still have lost a significant portion of its resale value simply because it has been in a major accident (you can sometimes get back some of this lost value if you file a diminished value claim). Further, a new car can also make it easier for a family to move on psychologically after a traumatic experience like a serious accident.

But if your sentimental attachment to your car is so strong that you just can't imagine life without it, you can take the money and apply it to repairing her on your own, which, depending on the extent of the damage, could get quite expensive. Furthermore, the check your insurance company cuts you will be reduced by the amount it feels it would have gotten from the salvage yard, a check that's already been reduced by your deductible, whatever that is. So if ol' Bessie is, say, a 14-year-old Le Sabre, that's going to leave you with a pretty small check. You also may have to file a salvage title with the DMV.

That said, consider this little bit of irony: a car's "total" value is almost always less than the sum of its parts — literally. Indeed, parts are what salvage yards are interested in, since they make their money by selling what's left of your car, piece by piece. If you are likewise inclined to sell it off for parts, you may actually make money. But keep in mind that you will have to arrange for the legal dismantling, advertising and sale of those parts on your own. Not to mention the fact that the rusting, rotting carcass of your old car will be living somewhere on your property for the foreseeable future. And even if you're OK with that, consider also that dead old cars become dangerous playpens that neighborhood kids find hard to resist. Need we say more?

In any case, if you want to hold on to a car that's been considered totaled, inform your agent as early as possible in the process, since the longer you wait, the closer your car gets to being auctioned off to the highest bidder at the salvage yard.

Step 7: Move on: get your car repaired or get it replaced.

Depending on how long your rental car agreement provides you with transportation, you may have to start looking for a replacement car very soon if you car has been totaled. It may behoove you to be thinking about that even before the auto insurance company has determined whether it will repair your car, or how large a check it will write you.

Remember also that if your car has been totaled, your settlement must include taxes, title and license fee for a comparable replacement. Likewise, the settlement must make clear the value of any deductions taken on account of salvage matters if you're keeping your totaled car.

One final bit of advice: If your vehicle was not totaled, do not let the auto insurance company dictate which repair shop you use. They can make recommendations, sure, but definitely find out why they recommend a particular shop. Compare their recommendations to those you get from friends and colleagues.

Dealing with car insurance matters after an accident is no fun. Just keep in mind that the sooner you take care of all of this, the sooner you and your family can put this whole thing behind you.