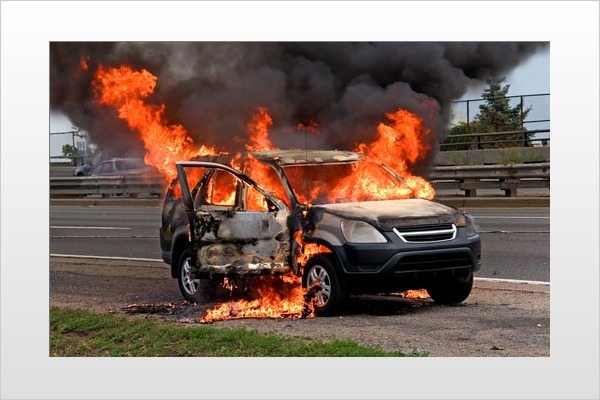

SUV owners who are faced with rising gas prices have found a new way to get out from under their high car payments — arson.

This trend was spotted by a Southern California arson task force in the summer of 2005 when gas prices spiked. At one point, firefighters responding to a report of a vehicle fire arrived at the Los Angeles River Bed to find two SUVs burning at the same time.

Investigators found the arson-for-hire ring involved a new-car dealership in Cerritos, California. Debt-weary SUV owners contacted the finance manager, hoping to trade in their gas-guzzler for something cheaper. They were then put in touch with an arsonist who told them to leave the keys in the ignition and $300 cash in the glovebox. An arsonist would then take the car to a remote location and set it afire. After the car was torched, the owners would then contact their insurance company and report their vehicle stolen, expecting their debt to be cancelled. Instead, they were investigated for insurance fraud.

A sting operation was arranged and an undercover officer posed as an "upside-down" SUV owner who wanted his vehicle burned. "Upside-down" refers to a loan where more money is owed than the car is worth. The vehicle was left at a predetermined location with cash in the glovebox. However, the would-be arsonist didn't know there was a "dash cam" installed in the car to videotape his actions. When the arsonist removed the money and started to drive away, investigators hit a kill switch and triggered the door locks, trapping him inside. Simultaneously, warrants were served on seven other people involved in the arson ring.

The loser in all this is the driving public. "You and I pay for it in our premiums," said Robert Rowe, arson investigator for the City of Downey and a member of the task force. "Insurance premiums for everyone increase when crimes [like this] are committed."

Rowe said that "the likelihood of being caught [for vehicle arson] has increased tremendously. It used to be a dark secret but the secret is now becoming revealed. Investigators are now being trained and are networking with the insurance companies to uncover these crimes."

At the root of the problem: People pay too much for a vehicle they really can't afford.

"Because of the way the economy has gone, the gas prices skyrocketing the way they have, we started to see a peak" (in arsons), Rowe said. "People that had the gas-guzzlers that got eight miles per gallon, they started to get hit hard. They didn't want those cars anymore."

Faced with rising gas prices, people who are trapped in a high-payment lease have no easy way to escape without a stiff penalty.

"People will lease a car for 84 months with zero down and they have some outrageous payment," said Rowe. "They start to realize they are living beyond their means."

The responsible solution would be to advertise the car for sale, pay off the loan and switch to a more affordable ride (even leased cars can be bought and then sold to get out of high payments). The irresponsible solution some people choose is to burn the vehicle and let the insurance company pay what is owed.

A former firefighter from nearby Lynwood, California, said, "We used to get called out on vehicle fires and when we got there we would find a brand-new car was burning. Some of them were stolen but we knew that most of them were people trying to get out from under their car note. It seemed like it happened just about every night."

Jennifer Mieth, manager of fire data and public education at the Massachusetts State Fire Marshall's Office, said car fires are "cyclical." She added, "When times are good, fires are down. When they are bad they go up."

In 1984, Mieth said it was "commonly accepted for Mr. and Mrs. Citizen to 'sell' their car back to the insurance company by lighting it on fire." To put a stop to that, the Burned Motor Vehicle Reporting Law was passed in 1987. This required the owner of a burned vehicle to complete and sign a report that must also be signed by a fire official from the department where the fire occurred. The new law was the most likely reason that vehicle fires dropped 95 percent, from a high of 5,116 in 1987 to 217 in 2004.

Vehicle arson has had a long and occasionally humorous track record over the years. In Texas, a car salesman was arrested after offering his customers what he called a "rotisserie program." He would have their cars torched; then, after they collected on the insurance, he sold them a new car. In another part of the state, two students were arrested after they torched their high school teacher's car in exchange for passing grades.

Rowe, a firefighter since 1994, is in charge of contacting owners of burned vehicles to make sure their stories add up. While he hasn't seen any "rotisserie programs," he has heard his share of lies. Often he will begin his investigation by contacting the dealership where the car was purchased to see the sales jacket (loan contract) of a burned car. If the owner is upside-down, and particularly if they recently purchased "gap insurance" to make sure they were fully covered, they fall under suspicion.

Actually, torching your own car isn't illegal, although as Rowe points out, if you have financed it, "you will pay for that burned-out shell for the rest of the lease." However, if you report the fire to your insurance company as accidental, when in fact it was arson, you have committed insurance fraud.

"In the majority of the fires we have on the freeways, nine out of 10 times the owner is still with the car, or close by," Rowe said. So when a car is found burning, and no owner is in sight, it quickly becomes suspicious. In most arson cases, the car is reported stolen. But due to sophisticated anti-theft devices, it's not easy to steal a car without the key. Many owners become vague when Rowe asks them to account for the second key. Often, they maintain the dealership never gave it to them when they initially purchased the car.

"We also look at the burn pattern [in the vehicle] going from the area of least damage to the area of most damage," Rowe said. "People who are burning it for insurance purposes want a total loss. The only way to do that quickly and efficiently before the fire department gets there is to use an accelerant."

Rowe is not the only one who has seen an increase in SUV fires. Arson investigators in San Diego County saw vehicle arson go up 34 percent between 1998 and 2002, prompting analysts to surmise that more people facing economic hardship may be setting fires to their cars to escape high payments.

Meanwhile, nearly 20 percent of all arsons occur in vehicles, according to the U.S. Fire Administration. Additionally, arson is the second-highest cause of vehicle fires.

To better investigate these crimes, Rowe has educated himself on the car-buying process. What he sees shocks him. "The deals are out there, but when the pencil meets the paper the deals really aren't that great. You'll see a car payment that is incredible and their rent is incredible but their income doesn't support either.

"People become desperate during financial hardship," Rowe observed. "It's not because they are bad people; they just get pushed into a financial corner and they make poor decisions. There are ways out of it — but people want a quick fix."

For anyone considering this "quick fix" Rowe said he wanted to send them a message. Quoting the line delivered by Robert De Niro in the 2000 hit movie Meet the Parents, he said, "I'm watching you!"