The crux of Michigan’s no-fault system is the Michigan Catastrophic Claims Association (MCCA), a state-created nonprofit that helps insurers shoulder the burden of having to cover unlimited, lifetime medical benefits for policyholders who are injured in a crash.

The crux of Michigan’s no-fault system is the Michigan Catastrophic Claims Association (MCCA), a state-created nonprofit that helps insurers shoulder the burden of having to cover unlimited, lifetime medical benefits for policyholders who are injured in a crash.

Michigan is the only state in the country where insurers must provide such extensive coverage, and one of the only reasons they voluntarily provide coverage there is the existence of the MCCA, which reimburses them for claims payments that exceed $500,000.

Claims that exceed that $500,000 threshold are known as “catastrophic” claims, and they typically involve severe, disabling injuries to the spinal cord and/or brain.

Reform-minded legislators and groups say the MCCA and no-fault claims it funds have pushed up auto insurance costs for everyone in the state. We take a look at the controversy surrounding the association.

How It Works

Every insurer selling auto or motorcycle coverage in the state is required to be a member of the MCCA. And to fund the MCCA, those insurers must pay a $175 fee for each vehicle they insure.

So if insurers get charged the fee, how does that affect you?

Auto insurers pass the cost onto their policyholders, who see it on their bill either as a part of the personal injury protection (PIP) coverage they’re required to have or as an MCCA “recoupment fee.”

Since its creation in 1978 up through June 2012, the MCCA saw more than 28,00 reported claims and paid out $9.9 billion to claimants. The MCCA expects those claims to end up costing around $85 billion.

Most of those claims are for injuries that lead to paralysis, coma, and other serious conditions.

Pros

The MCCA is an integral part of the state’s no-fault system, providing a “reinsurance mechanism” for the PIP benefits that seriously injured policyholders rely on for their medical expenses, according to the association.

Pre-MCCA, insurers had difficulty getting financial support from reinsurers in order to back up the coverage for no-fault policies issued in the state.

If it weren’t for the MCCA, medical costs for many of the worst injuries that occur during a car crash would likely be on the backs of policyholders.

An anecdote will show how the state’s one-of-a-kind no-fault system has served the state’s drivers:

Take Ann Manning as an example. A week from getting married, a crash with a drunk driver paralyzed the 20-year-old from the chest down. But the benefits Manning received under no-fault laws has helped her “lead a full, functional, and independent life” since the crash, according to the Coalition Protecting Auto No-fault (CPAN).

The post-crash lives of many drivers are eased by the state’s no-fault system, which helped Manning financially with injuries that have cost more than $1 million in medical expenses. Without the MCCA guaranteeing funding for costly claims, insurers would likely leave Manning and others like her on their own to pay for the majority of their expensive crash-related injury bills.

Cons

Gripes about the MCCA usually go back to a single point: cost.

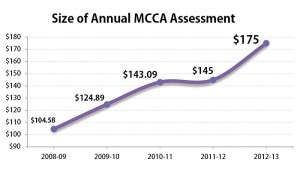

The per-vehicle fee charged to insurers has increased year after year, going from $104 in 2008 to its current $175 to support the similarly increasing cost of catastrophic claims.

CPAN, which provided the aforementioned anecdote on its website, is actually a part of the many reform groups taking aim at the MCCA for those ballooning costs.

The Great Lakes State is generally known as the most expensive for auto coverage, with Michigan car insurance premiums rising by more than 30 percent over the last decade, more than double the pace that premiums rose nationwide during that period, according to the III.

With such steep spikes in costs, reformists are also calling for the association to become more transparent.

“All Michigan drivers are required to have auto no-fault insurance and largely fund the system through their insurance premiums,” CPAN said on its website. “They have the right to know how their money is being used and how their rates are being determined.”

Others have harsher criticisms.

Tim Skubick, a columnist covering Michigan for MLive.com, called the MCCA a “beast” created in the vein of “the Soviet Union model of government.”

Recent Headlines

That transparency effort has produced several court-related headlines after the MCCA was sued by CPAN and a medical providers group seeking disclosure of the association’s financial and claims records.

A judge sided with those groups in a ruling issued late last December.

But the MCCA countered with a recently filed appeal in which the association said its relevant records are already available on its website through annual reports, claims statistics, and financial audits.

In its appeal, the MCCA also contends that it is not a public body as believed, but rather a private association funded by private insurers that isn’t subject to common laws that require public access to documents and meetings.

Transparency efforts are also unfolding outside of court. A state senator recently reintroduced two of his bills to the state Legislature that would make the MCCA subject to open meeting rules and give the insurance commissioner wider powers as a voting member of the MCCA’s board of directors.

According to Skubick, the soaring price of auto insurance has damaged public trust in the MCCA, justifying demands for stronger oversight. Without more transparency, he said, the state’s drivers would be blindly paying into a public fund wracked by volatile costs.

“This is basically a debate over taxation without representation,” Skubick said.