A recent analysis of state auto insurance laws from OnlineAutoInsurance.com showed that the repercussions for driving without coverage vary widely from one state to the next. But does the severity of a state’s law against driving without insurance have any bearing on how many people in that state end up driving uninsured?

Nationwide, the fines and penalties attached to uninsured driving usually run up to several hundred dollars, and a little more than half of states require a license suspension period, at least until the offender purchases a policy.

According to the Insurance Research Council (IRC), the nationwide rate of uninsured drivers was about 13.9 percent in 2009. The state uninsured rates ranged from 4.5 percent of drivers in Maine and Massachusetts all the way up to 28 percent in Mississippi.

So do stricter-than-normal uninsured penalties in a state mean that state has a lower rate of uninsured drivers?

In short: not really.

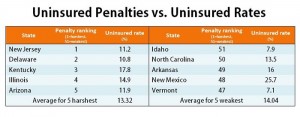

The average uninsured rate was about the same for the five states with the harshest and the five states with the weakest penalties. The average for the five harshest was 13.3 percent. The average for the five weakest was 14 percent.

Most States with Harshest Penalties Have Middle-of-Pack Uninsured Rate

Even faced with the most severe consequences, New Jersey’s motorists drive without insurance at a rate that lands the state around the middle of the pack; the Garden State has the 26th-highest rate of uninsured drivers in the U.S., with about 11.2 percent of motorists on the road without policies.

Fines in New Jersey for first-time violators range from $300 to $1,000, and other penalties include a yearlong license suspension and community service. No other state in the country has as long of a license suspension period for first time violators as New Jersey. And no other states impose such a sizeable fine that’s accompanied by both a long license suspension period and a community service requirement.

The state with the next-harshest penalties is Delaware, where a fine between $1,500 and $2,000 can be levied against first-time violators, who also face a six-month license suspension. The state also has a less-than-average uninsured rate, with 10.8 percent illegally going without insurance, the 28th-highest rate of uninsured motorists.

In fact, four of the five states with the harshest penalties had uninsured rates that were below average, but only slightly. And Kentucky actually had a higher-than-average uninsured rate, landing in 7th place with a 17.8 percent uninsured rate. In Kentucky, a one-time violation brings a fine between $500 and $1,000 and a six-month license suspension. Second and subsequent offenses bring an especially pricey fine between $1,000 and $2,500 and a possible jail sentence up to 180 days.

States with Weakest Penalties Have Mixed Results

The state with the softest penalties for driving without coverage is Idaho, which only charges a $75 fine against first-time violators and includes no license supsension period. But despite the lax penalty, the state has only the 37th-highest rate of uninsured drivers, with an estimated 7.9 percent of drivers lacking coverage. That’s a lower rate than any of the states that were ranked as having the harshest penalties.

Of the bottom five states with the laxest consequences, only one had an uninsured rate that was in the top 10 of all states in the U.S. But that state, New Mexico, is grappling with more serious problem with its uninsured motorists, who make the Land of Enchantment the state with the second-highest rate of uninsured drivers in the U.S. In New Mexico, both first-time and repeat offenders face maximum fines of $300, and nearly 26 percent of drivers are estimated to take their chances by driving uninsured.

Arkansas, with 16 percent of drivers lacking coverage, has the 11th highest uninsured rate but also has looser-than-normal penalties. Fines and fees in the Natural State amount to $270 and registration suspension until coverage is proved.

Vermont, which requires offenders to pay only between $250 and $500 for driving without insurance, had an uninsured rate of just 7.1 percent, the 39th-highest in the country.

Finally, North Carolina, the state with the 2nd-weakest penalties, had a rate that was just about average: 13.5 percent.

Ironically, the states the IRC estimated to have the highest and the lowest uninsured rates had similar consequences for uninsured drivers.

Massachusetts and Maine, which both had the lowest uninsured rates of any state at 4.5 percent, both have maximum fines of $500. In Massachusetts, offenders also have their license suspended for 60 days, while Main offenders get a license suspension until they can prove coverage is in place.

At the other end of the spectrum, Mississippi had the highest uninsured rate: 28 percent. But despite the serious problem there, the fine is only $500 and a suspension of driving privileges until coverage is in place.

Visit here for listings of each state’s penalties from OnlineAutoInsurance.com.