While discussing the topic of auto insurance, or while looking through the policy papers, new terms and information used can be confusing and add to the stress of understanding auto insurance. When reading through the policy, you’ll notice what’s known as the declarations page. This page is of vital importance, as it contains the most pertinent information you will need regarding your auto insurance policy. As you read through it, you will be given a basic outline of your policy, along with the insurer’s information and the driver’s information.

While discussing the topic of auto insurance, or while looking through the policy papers, new terms and information used can be confusing and add to the stress of understanding auto insurance. When reading through the policy, you’ll notice what’s known as the declarations page. This page is of vital importance, as it contains the most pertinent information you will need regarding your auto insurance policy. As you read through it, you will be given a basic outline of your policy, along with the insurer’s information and the driver’s information.

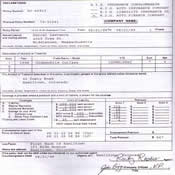

To break the declarations page down further, we’ll discuss each aspect presented on the page, and this is done in no particular order, meaning your declarations page may or may not have the same information in the same order listed here. First we’ll mention the auto insurance company’s information on the page. The declarations page will have the name of the insurance company, as well as their contact information including a phone number and address. If you need to contact the company, the information is readily available here and also on the insurance card that you should have somewhere in your car in case it is immediately needed.

Next, you should find your policy number. Your policy number is a way the auto insurance company can identify you without using your name. This lessens confusion as there is typically more than one client sharing the same first and last names. A policy number can include numbers and letters together, or just numbers. You will need to know your policy number any time you want to contact the insurance company. You can also find your policy number on the insurance card.

Information regarding the coverage you have purchased is also included in the declarations page. The coverage you purchased will include the minimal requirements provided by your state, as well as any additional coverage options you felt the need to purchase. Bodily injury liability, property damage liability, personal injury protection, and uninsured motorist bodily injury may be some of the coverage options you purchased that will be listed on the declarations page.

The cost of each coverage you purchase for your auto insurance policy will also be listed on this page. The price of your policy is determined by individual factors, including the cost of coverage you added to your policy. If you carry additional coverage options past the state’s requirements, you can look at these “extra” options and decide if they fit into your budget, or if you can add more coverage for added protection.

Your deductible amounts may also be listed in the declarations page. A deductible amount is the amount of money you are willing to pay, out-of-pocket, when you make a claim to the auto insurance company. Any time you file a claim and expect the insurer to cover an accident-related cost, the insurer requires you to pay upfront a deductible. This amount can range from $250, to $1,000 or higher. The lower deductible you choose for your policy, the more expensive your policy premium will be.

page or if you would like to start saving on auto insurance today visit our main site at Online Auto Insurance to compare qutoes from multiple companies.