In the 12 years I worked in car dealerships, I was involved in thousands of car sales, and I learned a lot of things that make car shopping easier for people. In this article, you'll find some of my favorite tips. Some need no explanation. Others do, and so I've added some insights to help you see why they're important.

For example: Don't assume that a car has a certain feature that you want. I once was showing a midsize sedan to a guy who came into the dealership without his wife. We went on a lengthy test-drive, and then he bought the car. I didn't know it, but he and his wife were going to use the car for long road trips, and because of his bum knee, his wife was going to do most of the driving.

On the first road trip, he discovered that he couldn't sit comfortably in the passenger seat because it didn't have the same power seat adjustments the driver seat had. By the time he learned this, the car already had a few thousand miles on it, and he would have taken a sizable loss on trading it in.

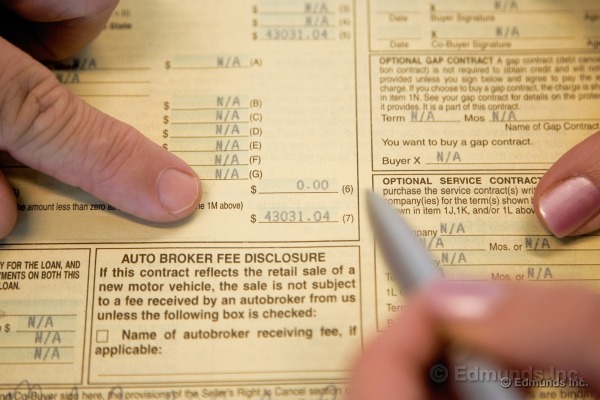

He found out (the hard way) a basic truth of car buying: There is no clause in a sales contract that allows a buyer to return a car because it's missing a feature he assumed was there. Car sales are, largely, final.

So read these tips and put them to work for you. They came to me through years of experience, but you can benefit from them in no time.

Buying a Car

1. If you're in no rush to buy a car, the end of a model year is a great time to get a deal. Determining when this is for a particular car can be difficult, but if a dealer has two years of a new vehicle on its lot (say, 2014s and 2015s), chances are the older ones are going to be priced to move. The last week of the year is another good time to buy. You'll find lots of specials and manufacturer incentives at both times of year.

2. If you're looking to get information on a car or talk about a deal, but you aren't quite ready to buy, a weekday afternoon is a great time to go visit a dealership. You'll get more personal attention than you would on a busy weekend.

3. Don't be afraid to listen to dealership suggestions. I'm not talking about bait and switch, but salespeople offering really good alternatives. When I sold cars, it was common for people to come looking for a particular model because of its low sticker price, but then drive out with a nicer car at the same or a lower price, thanks to the special programs and incentives that they didn't know existed.

4. If you've already picked out a car from a dealership's online inventory and worked out a price, do as much of the deal paperwork you can get over the phone. In many cases, you can be in and out of a dealership in less than an hour if you started the deal-making process online and over the phone. Why sit around in a showroom if you can avoid it?

5. Test-drives are still an important part of car buying. Bring along the people who will regularly ride in the car with you, if possible. Have them try all the seats. It's better to learn that your teenage son doesn't fit in the backseat before you buy the car, not after.

6. When you're trying to negotiate a lower sales price, give the dealership a reason to discount the price. If you'll use the service department, say so. If you'll refer friends, be sure to say that, too. If you're likely to give a perfect survey or buy a future car from them, share that with the dealership, too.

7. Check your insurance rates on the car you're looking to buy before you buy it. This is one that people often forget to do when car shopping, and it can really come back to bite them. Here's an example:

I worked with a mom who leased a V6 sedan that she was going to share with her teenage son. She didn't check her insurance rate ahead of time, and when she called to add the car to her insurance policy a few days later, she was surprised how much more it was going to cost. (Teenage boy plus V6 equals higher insurance.) She wanted to return the car, but it was too late. As with "missing" car features, there is no clause in a sales contract that lets you return a car because insurance costs more than you expected.

8. Make sure you really like the car you're buying and that it really meets your needs. It sounds so obvious, but go check how many one- and two-year-old used cars sit on car lots. Most of them are trade-ins from people who just bought the wrong car. Take your time and make the right choice.

9. When deciding where to buy, read online reviews to help you pick a dealership. In addition to checking their ratings, see if the dealerships you're considering include free perks such as lifetime oil changes or free car washes. Or free manicures and massages.

10. If you need an extended test-drive, just ask for it. One of my customers drove over a steep grade on her daily commute. It was 20 miles from the dealership, but because it was very important to her to test the four-cylinder crossover SUV's ability to climb the hill, that's where we went. A good car salesperson will understand your needs, and let you test the car accordingly.

11. It's smart to ask if you can drive the car home and park it in your garage. Most dealerships will go along. Yes, I have seen people buy cars that didn't fit their garage or parking spot. There's no clause in the sales contract for returning a car because it doesn't fit your garage.

12. If you're serious about your music, bring some along to test out the vehicle's audio system. Stereo specs don't tell the whole story.

13. Never buy a car you haven't test-driven at some point. Online specs and descriptions are not a replacement for a test-drive.

14. Don't get caught up on only one aspect of a deal. There is more to an overall good deal than simply a low selling price. Pay attention to everything that's being offered to you, including trade-in value, interest rates and additional costs.

15. If you've tried to buy the same car at five different dealerships, made the same offer five times and no dealer has accepted it, it's time to face facts: It's not them, it's you. Or, more precisely, it's your offer. You can either raise your offer or pick a less expensive car.

16. Get a good explanation of your new car's features. I've met so many people who traded in cars after years of owning them without ever knowing how to use some of the features. And in some cases, they didn't even know the car had a particular feature.

17. If you're unsure of your credit standing (or you know it's bad), bring a copy of your paycheck and a home utility bill to the dealership to prove you have income and to confirm your home address.

18. When you're car shopping with iffy credit and you want the dealership to arrange the loan, go there while banks are open. Since the dealership will be trying to find a lender to write the loan, you'll greatly increase your chances of getting approved for a car during "bankers' hours."

19. If your credit is really bad, don't give up hope. You still may be able to get a fair car loan. Check with a big and big-name car dealership. Bring along a copy of your credit report and visit during bank business hours. Ask a sales manager to review your credit profile and see if there is anything the dealership can do for you. Get the general manager involved, if possible. (GMs are famous for not grinding you down. They just want to get the deal done.) Sometimes these dealership big shots can make deals happen.

20. Don't overbuy. The most expensive model in the line isn't necessarily the best one for you. I once worked with a retired couple who wanted a top-of-the-line car. They insisted on all the available bells and whistles. But they weren't particularly tech-savvy and never really got the hang of the navigation system, which they didn't really need, but which controlled both the air-conditioning and radio. They spent endless hours with me at the dealership trying to master the thing. I was happy to help them, but I think if they had skipped the pricey navigation system, they would have enjoyed the car much more.

21. Be very careful about co-signing a car loan. If the person for whom you co-sign stops paying, you're on the hook for the money, or the poor credit reporting, or both. I can't count the number of car shoppers who've run into trouble because of co-signing for friends, family or co-workers. The bank doesn't care that your ex-boyfriend was supposed to make the payments and that you just helped him get the loan. That repo now belongs to the both of you.

Leasing a Car

22. Do you drive a lot of miles every year? Consider a high-mileage lease. It may cost you less over three years than buying and then trading in a high-mileage car.

23. If you trade in your car every three years or so, it may make more sense for you to lease a car. You'll likely have a lower cost over the three years and if you decide you'd like to keep the car longer than the term of your lease, you can buy it when the lease is done.

24. If you've gone over your lease mileage limits and buy the car out, you will have no over-mileage penalties.

25. You can buy out your lease at any point during the lease contract. Don't ever think you're "stuck in a lease."

26. If you are budget-conscious or can't afford unexpected expenses, leasing an inexpensive car may be a good alternative to financing a $6,500 used car with high mileage, for example. You will save the cost of upkeep and if you lease for three years, the car will be under factory warranty the whole time.

Buying a Used Car

27. If you can choose between a certified pre-owned (CPO) car and a non-CPO used car, go with the CPO. The selling price will likely be higher, but there are some significant benefits beyond just the extended warranty that comes with a CPO car. Carmakers review vehicle history reports for past problems and pay close attention to overall vehicle appearance.

28. If you're financing your used-car purchase, you're likely to get a lower APR on the CPO car, which can help you save interest charges over the life of the loan.

29. Leasing a recent model used car is often possible, and can be a fantastic idea since it's a newer car for less money. If you're shopping at a new-car dealership, ask the sales staff if it also leases used cars.

30. Don't try to pick apart a used car in hopes the dealership will offer a dramatic discount. The dealership is likely aware of every scratch, ding or dent. Instead, ask the dealership to fix the problems, if possible. Remember, though, that all used cars will have signs of wear. They're used.

31. Keep in mind that an older, high-mileage car will need upkeep. Budget money for that. No matter how clean that car is, you will eventually need to put money into it.

32. Don't summarily reject a car because there is an incident on the vehicle history report by Carfax or AutoCheck. Virtually any car that's been fixed and paid through insurance will be reported to these companies. That could even include minor incidents, like parking lot dings. Get it checked out.

33. If a vehicle history report shows the car's been in an accident and you still want to buy the vehicle, get it inspected by an independent mechanic or body shop. For a small fee, a body shop will likely be able to tell you if it was a major accident (think frame damage) or a minor one.

34. Before you buy, get a good idea of what maintenance will be required and how much it will cost. If you buy a car that is nearing 75,000 miles, for example, look in the service manual for the recommended service at that mileage. Then go to the service department and ask how much that will cost. Don't forget to check on tire costs.

35. If you've been watching a particular used car online, call the dealership to be sure the car is still in stock before you pay a visit. Online inventory changes don't happen in real time, so it can take hours — or even days — for online inventory to be updated.

36. When you're on the used-car lot, take a look at the window sticker sales price. If that is the only price displayed, you likely have some wiggle room in the price. If the sales price on the sticker says one thing and there is a much lower price written on the window (or it's being offered online), you're likely at (or close to) the dealership's lowest selling price.

37. Knowing how long a used car has been on the lot can help you get a better price. Here's how to find that information. Dealerships run vehicle history reports from Carfax or AutoCheck when cars come in as trades. Ask to see the car's report, and make a mental note of when the report was printed. If the date is recent, then the car is likely new to the lot and there's not much bargaining opportunity. But if the report is more than 60 days old, that's a good indication the dealership is willing to move on the price.

38. Rental cars can be a good used-car option. Rental car companies have strict guidelines on vehicle maintenance and, as a rule, will follow the carmaker's recommended services to the letter. They will almost always have higher miles than usual for the year, so they can often be picked up at a good discount. And contrary to popular belief, not all rental cars are used for racing and burnouts.

Trading in a Car

39. Don't detail your car before trading it in. The spruce-up won't get you any extra value, and it's a surefire clue to the dealership you're prepared to buy your next car — right now.

40. There's no need to fix something minor on your car before trading it in. The dealership can probably do the repairs for less than you can, and in most cases, you won't get back in trade-in value what you spent to make the fix.

41. No matter how clean your trade-in, if it's old, it's just old. Your love for it will not increase its value.

42. Check trade-in values at Edmunds.com before heading to the dealership. Focus on the trade-in and private-party values. The third value, "Dealer retail," is the estimated price the dealer will ask for the car when he's selling it. It has nothing to do with what you should expect the dealer to pay you.

43. In order to determine the value of a trade-in, you may be tempted to scan the Web to see what dealerships are asking for cars that are similar to yours. Resist the temptation. What a dealership asks for used cars and what it eventually gets are two different things.

44. Bring along all the keys for your trade-in, with the registration, pink slip or payment bill and repair history, if you have it. If you don't have the title nearby, that may be OK, too. Just be prepared to pay a small duplicate title fee of about $40.

45. Before attempting to trade in a car, know whose name is on the title. Is it only you? Or you and your spouse? Know who will need to come to the dealership to sign off on the vehicle.

46. If you're thinking of trading in a car, do it before your annual registration is due. You will not get a prorated value for having a paid registration.

47. If your trade-in's registration is past due, or if the vehicle has tickets, be prepared to pay for those when making your deal.

48. Make sure to keep the release of liability form you get from the dealership finance department. The car you trade in may stay attached to your name until the dealership sells it to somebody else. If the traded in vehicle gets a parking ticket, there is a good chance that ticket will be sent to you, as the last registered owner. The release of liability form will come in handy when explaining to the parking authorities that you're not responsible and won't be paying the ticket.

49. It's common to trade in a car that has a loan or lease balance. As a rule, the dealership should pay off the trade-in within 10 days. Call the lender about two weeks after making your new deal to ensure that the car has been paid off. If it hasn't, get in touch with the dealership to find out about the delay.

50. If you are still paying off your trade-in, complete your deal before the next payment's due date, especially if you're leasing, since those payments are typically for the month to come. There's no reason to pay for a car that you won't be using.