It began so innocently. And with such good intentions. Who could have predicted that something as simple as a lease buyout would lead me into a sea of red tape that would nearly drive me nuts?

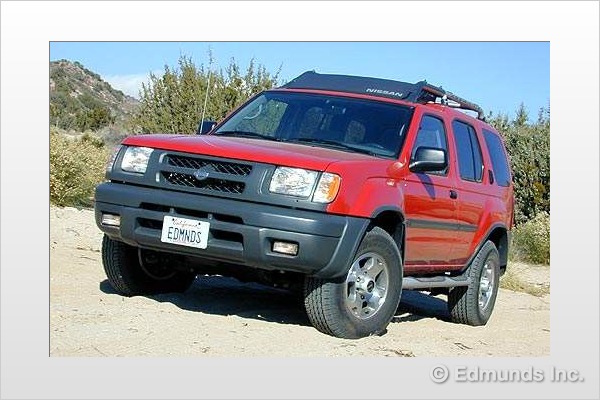

All we wanted to do was buy our leased long-term Nissan Xterra SE and sell it ourselves to avoid wear-and-tear charges and a $500 excess-mileage penalty. I called Nissan Motor Acceptance Corp. (NMAC) that leased us the Xterra and learned our buyout amount was $17,223. I told them we would be buying it and selling it to a third party. They said all I had to do was go to a Nissan dealership to complete the transaction.

"But what about the sales tax?" I asked, knowing that, if we could avoid paying the sales tax, it would increase our profit from the sale by about $1,300.

A similar issue came up last year when we bought our leased Honda Odysseyand sold it to a private party. Bank of America, which held the lease, facilitated the transaction without requiring us to pay sales tax. It's called a "third-party buyout." The buyer pays us our price, we pay the bank the residual amount of the vehicle and the bank hands the new owner the title. Then the new owner goes to the DMV and pays the sales tax.

In this case, the lease was held by NMAC and I didn't know what their policy on third-party buyouts would be.

"Just take it to any Nissan dealership," the NMAC spokesperson said. "The dealer will take care of everything."

I listed the Xterra for sale in the Auto Trader classifieds and soon had an offer. The buyer agreed to pay $18,300, meaning that, not only would we escape the mileage penalty — and possible wear-and-tear costs —- but we would make a profit. I broadcasted the good news to my co-workers and got kudos all around.

The next day the buyer backed out. He said he realized that it would actually be cheaper for him to buy a new car and finance it. Oh really? And where did he get this information? Well, he admitted, it was at the dealership that I had contacted to arrange the lease buyout transaction. He had called the dealer with some questions, got to talking and then next thing he knew.... I smacked my forehead in a "how obvious" expression. The dealership's finance manager knew I had a hot buyer. He stepped in and took away my business.

A week later, I had another buyer, a young woman. We negotiated a buying price of $17,900, and I began exploring ways to make this transaction without the "help" of a dealer. I called NMAC again and reached another representative. "Why can't we just buy the vehicle directly from you?" I asked. "We could send you a cashier's check."

The rep explained that NMAC was an "indirect lender," meaning that it couldn't legally sell cars. It had to be done by a licensed dealer or a financial institution such as a bank. I explored the bank option for a while, but we would still have to go to the DMV to register the vehicle. If we went to a dealership, everything could be done in one shot. Maybe I just hadn't found the right dealer, I thought, reaching for the phone.

I contacted another Los Angeles-area Nissan dealership. The finance manager asked if I had bought the car from their dealership. No. In that case, he said, his dealership would charge us $500 to perform the transaction. Furthermore, they would have to buy the car from us, and then sell it to the buyer at a newly negotiated price.

"Thanks anyway," I said. Click.

I called yet another Nissan dealership. The finance manager I reached sounded polite and agreeable. I told him I wanted his help making a third-party transfer. He seemed confused but finally agreed. "And you won't charge us double sales tax?" I asked. "No. We can avoid that," he said. I scheduled an appointment for the next day and called my buyer to tell her the good news. She was relieved to hear this because she'd just arranged the sale of her old car.

The next morning, I went to the dealership and ran smack into a huge problem. The finance manager had decided that he had to charge us both sales tax. This would cost each of us about $1,300. In that case, I said, we wouldn't do the deal. I left and decided to try to find another way to complete the transaction.

However, the next morning our buyer called in a panic — she needed to conclude the deal because she had sold her car. She was without wheels. I quickly called the DMV. After getting passed off to several experts I was assured that if I bought the car from the dealer, it was my right to resell it within 10 days without incurring double sales tax. I even found and printed a copy of the law in the California Vehicle Code that seemed to support this.

With these assurances in mind, I bought the car from the Nissan dealership and paid for the tax, title and license fees. I then picked up my buyer and we drove together to the nearest AAA office to register the car in her name. (In California, most DMV transactions can be done at the Auto Club without being subjected to a horrendously long wait.) For a moment it seemed that everything would go smoothly. But after a lot of haggling and repeated calls to the DMV, I was told that even though we had paid $1,348 in sales tax to the dealer, the buyer would have to pay the sales tax again to get the car registered. This, despite the fact that the two transactions were separated by only an hour.

Reflecting on this situation I realized that I was caught between three impenetrable entities: California DMV, Nissan North America and NMAC. Each player has rules and regulations that are so complicated even they didn't fully understand them. Furthermore, the rules of these separate entities weren't compatible.

Still, all I wanted to do was buy a car and sell a car. Why was that so hard?

The next step was to get the title so we could sign it over to the new owner. It took more than two months for the title to arrive. The delay was caused by the dealership's inability to fill out the paperwork properly. The DMV had to return the documents to the dealer for correction.

While waiting for the title to appear, I called Ford Credit on another matter. I wanted to find out what the buyout price would be on our long-term Lincoln LS. The Ford representative volunteered an interesting piece of information. "If you're interested in selling the car yourself, one of our dealerships can help you avoid paying a double sales tax," she said. "It's a third-party buyout. We do it as a courtesy to our customers."

How interesting, I thought after hanging up, that the NMAC told us the third-party buyout couldn't be done through them. Then another Nissan dealer wanted to charge us $500 to arrange it and negotiate a new purchase price. But here was Ford volunteering to help.

Over two months after we started the Xterra sale, we reconvened at the Auto Club to finalize the transaction. We paid sales tax for a second time with the intention of contacting the California State Board of Equalization and applying for a refund.

Let me conclude by summarizing a few things we learned. If you are considering buying your leased car, and reselling it, keep these things in mind:

The next time the lease of one of our long-term fleet cars is up, we might buy it for resale. This would be a good way of seeing if I've finally got this process figured out. But if it's like the experience I've just had, the men in the white suits with butterfly nets will take me off to a happier place — a place where there are no DMVs, no dealerships and no sales tax.