If you're under 25, the lion's share of expenses to keep your car on the road will almost always come from hefty insurance premiums. Lots of new drivers don't realize that over the course of a couple of years, premiums can nearly end up equaling the cost of a car itself, if you don't play your cards right. That's why it's important to be smart and know all the different ways to keep your insurance costs as reasonable as possible.

Unfortunately, no matter how hard you look, genuine bargains for young drivers are few and far between. In the eyes of insurance companies, you have a bad reputation when it comes to your record on the road.

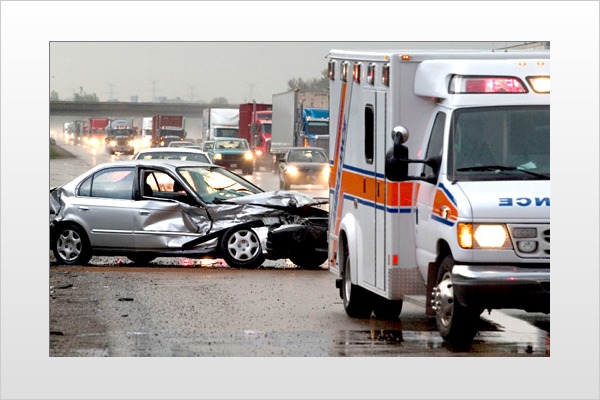

Young drivers are accident-prone and pay for it with their checkbooks and, in many cases, their lives. According to the National Highway Traffic Safety Administration (NHTSA), 43,443 people died in automobile accidents in 2005. Of those, 13,562 deaths were drivers aged 16-25. Per 100,000 people, drivers ages 21-24 had the highest fatality rate, and drivers ages 16-20 had the highest injury rate.

NHTSA reports that more men than women die each year in automobile accidents — 2,575 males between the ages of 15 and 20 died in accidents in 2005, versus 892 females in the same age bracket. Men ages 15-20 are also more likely to be involved in alcohol-related car crashes. Sorry, guys. On top of everything else, this means young males will typically pay higher insurance rates than females.

Although young drivers are not the insurance companies' favorite client, there are still a handful of ways to keep your insurance premiums from breaking the bank.

Rule #1: Be safe and drive carefully.

Your parents have probably already said it a million times, but it's true: A clean driving record is the best tool any driver can carry with them on the road. "Once you get one ticket, you're very likely to get another — and the insurance companies know this," says Carolyn Gorman, vice president for the Insurance Information Institute. "The 16-25 age group has more accidents per mile than any other age group, so they ultimately pay more. In order to get the best rates, a person should have no tickets of any sort. They should just be a straight arrow and build a solid record of safe, accident-free driving."

Besides the fact that it means you're driving safe, it means you will always qualify for the lowest possible rates in your age group.

Of course, it's not always possible to avoid tickets and accidents, especially when you're inexperienced behind the wheel. If you do find yourself with a ticket, don't be too discouraged. Learn from the mistake and hopefully it will make you a safer driver in the future. Whether you have a clean record or if you find yourself with a speeding ticket (or four), spending a little bit of time in a driver safety course can save you hundreds of dollars each year and also make you a better driver in the process.

Depending on your insurance provider, many companies either offer their own customized safe driver programs for young drivers, or will offer discounts for completing a certified third-party course.

Rule #2: Do your research and find a car that's both safe and has insurance premiums that fit your budget.

You really don't want to be driving your mom's old minivan around town — especially when you've got your eyes on that brand-new Mustang sitting on the dealer's lot. Insurance premiums differ widely for each car, and if price is really a concern, doing your research before buying a new ride can save you hundreds, if not thousands, over the course of several years.

New cars, SUVs, sports cars and expensive luxury models will generally cost more to insure for young drivers than a used or economy car. But insurance companies will also give discounts for cars that offer special safety features, like side airbags, antilock brakes (ABS), vehicle stability control and even car alarms.

Try to find a car that has as many safety features as possible and still fits in your budget. And let your insurance company know all the safety options it's equipped with.

"One of our main tips would be to look for vehicles that have lower insurance losses," says Russ Rader, spokesperson for the Insurance Institute for Highway Safety. The IIHS publishes a guide to recent insurance injury, collision and theft losses on most major makes and models.

Price insurance costs on several different models and factor this into your decision-making process. Talk with your insurance company before purchasing anything, to make sure you have an accurate estimate of your six-month premium. Raising the deductible could make a substantial difference in your annual premium. Also think about paying for small claims, dents or fender-benders out of pocket.

Rule #3: Study hard and do well in school.

Lots of students don't realize that those nights staying up late to study chemistry can also save them hundreds of dollars every time the insurance bill comes in the mail.

Most insurance companies give discounts for good grades, usually for a B average and above. "If a family adds a young driver who turns around and gets tickets, everyone suffers," Gorman says. "But the driver can do their part by getting good grades, because many companies view a new driver on the honor roll as a better risk."

To qualify for these discounts, fax or e-mail your most current report cards to your insurance company each semester or pay period.

Rule #4: Register with your family's insurance and get added as a secondary driver on the least costly car.

Insurance companies like big happy families of drivers. Most will offer some form of family or group discount for multiple cars on the same policy. Staying on your family's insurance plan can save 20 percent or more on your yearly insurance premiums.

Even if you plan to pay your car insurance on your own, it might make good sense to be a part of your parents' policy and figure out an arrangement with your folks directly. And if there are more drivers than cars in your family, request to be added as a secondary driver, instead of being listed as a primary driver.

Driving the oldest or least expensive car in your family will also cost less than driving the family gem.

Rule #5: Shop around for quotes from multiple insurance carriers, but be sure to compare apples to apples!

Your parents most likely already have a relationship with an insurance company or agent they like, but don't be afraid to shop around and price several different options. Just as visiting different dealerships can get you a better price on a car, fielding quotes from several insurance providers can also find you a much better deal. The Internet is a great resource for researching prices. But make sure that when you compare quotes, you compare the same coverage (for example, the same deductible, uninsured motorist coverage, personal injury protection limits, etc.).

Be safe, shop wisely and you'll have extra dough to spend taking great trips with your wheels — instead of pouring every cent into your insurance premium.