QuestionI financed a car for my son. It is used and has a 12 month powertrain warranty. Total purchase price was $6,200 we put down $1,000. Amount Financed was $5,200. We bought the car in may and there is now $5,043 left they said. It started making noise so we brought it back for them to look at. They said they have to get us another car because the engine is shot. How does this work now? I don't want to get ripped off for what we already have paid so far and I don't want the payment to go up. I'm a single mom and don't want them to take advantage of me so please tell me what I should be aware of and how this works if you know. Thank you soooo much!

Answer

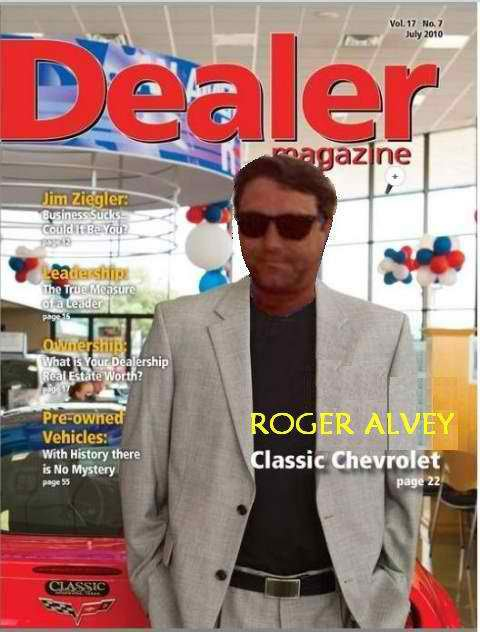

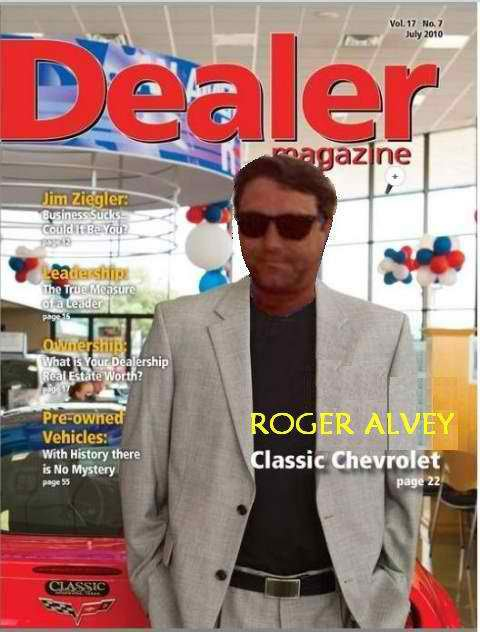

carguy

carguy  car guy

car guy

I need a little more info...

First off what state are you in?

Secondly, when you say it had a 12 month powertrain warranty was that something that they put on their cars or something you negotiated for or?

Do you have an actual warranty certificate of paperwork?

Is there an insurance company behind the warranty or just the dealer? and lastly

was this an independent dealer or a franchise dealer? OOps one more

Is the car financed through a bank or credit union or finance company or is the dealer carrying the paper?

In the mean time ...here is where you are at. If I were guessing I would guess that the warranty was included by the dealer as part of the way he markets his used cars and so he is probably on the hook for the repair bill. He has decided that it makes more sense for him to take you out of that car and put you into a different one and then he can run yours thru the auction w/no guarantee and get what he can for it. There three ways this can be done ...only one of which you should be agreeable too.

1. He can show the old car as a tradein on the new car (this is where it matters where the car is financed)and there is no way that you will not be screwed doing it this way. He will want to profit from this new transaction and so you will be financing the profits from the old deal and the new deal all in the next deal.

2. He can (and should) unwind the old deal (once again where it is financed matters alot here) and put together a new deal with no trade and with the paperwork showing your original 1,000 down on it ...this is the only way (or at least the preferred way you should agree to this...

3. You could find a new car for roughly the same money and have the bank do whats called a substitution of collateral which means they give the dealer the title to the old car and the dealer gives him the title to the new car and the payments term and rate on the loan stays the same and everything continues just like nothing happened...this way may work in your favor and is a possibility but you will need to be careful that you don't get traded into a worse position than you are in ...I can help you with that

4. I guess there are 4 options not 3 lol ...4th is you say no way Jose lease fix my car under my warranty

Get back to me with the additional info and I will get real specific with you

thanks

Roger