It’s a standard rule in the insurance industry that location plays a major part in the price you pay for coverage. But when it comes down to it, how much of a factor does it really play?

It’s a standard rule in the insurance industry that location plays a major part in the price you pay for coverage. But when it comes down to it, how much of a factor does it really play?

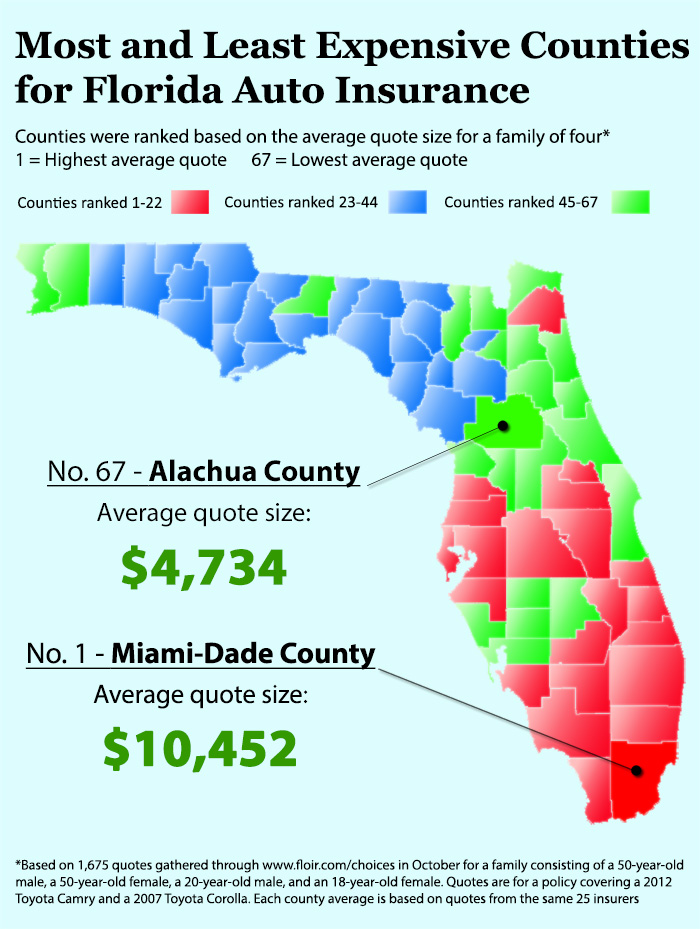

OnlineAutoInsurance.com ran an analysis of nearly 1,700 car insurance quotes in Florida from 25 companies and broke them down by the state’s 67 counties, from the costliest to the cheapest. What we found was a huge gap between the county that had the priciest coverage on average, Miami-Dade County, and the county with the cheapest, Alachua County.

How big was that gap? The average quote among all counties was $5,665. In southeast Florida’s Miami-Dade County: about $10,450, 84.5 percent above the average policy cost. In north-central Florida’s Alachua County: about $4,730, 16 percent below the average policy cost.

So, to reiterate: location, location, location.

Our county breakdown shows that all of south Florida’s counties are above the average cost of Florida auto coverage. The priciest areas lie on the eastern edge of the peninsula around Miami-Dade County. Nearby Palm Beach County and Broward County were 55 and 51 percent above the average policy cost, respectively.

A City Life Is a Pricey Life

As a guideline, policyholders shouldn’t expect cheaper coverage rates when moving to big cities with large populations. The state’s most-populated counties—Miami-Dade, Broward and Palm Beach—returned the highest quotes.

In those counties are the well-known, densely populated cities of Miami, Fort Lauderdale, and Boca Raton, all bustling tourist attractions that epitomize the urbanized city experience.

With that in mind, even some location-related, countywide anomalies begin to make more sense when looking at the breakdown.

For example, a cluster of counties in central Florida returned quotes under the average statewide cost. But nestled right above it in west-central Florida is Hillsborough County, where we found that the average policy cost was 47 percent pricier than the statewide average.

That county, the fourth most-populated in the state, is home to the Tampa Bay metro area, which holds major cities like Tampa and St. Petersburg.

City life inevitably brings denser populations, which inevitably brings higher instances of insurance-related crime. For citizens, that means a higher chance you’ll be victimized.

For insurers, that means they’ll probably pay out more on your and your neighbors’ policies, and as a consequence you’ll probably be charged more for coverage.

A report released this summer by the Consumer Federation of America (CFA) and North American Consumer Protection Investigators (NACPI) compiling anecdotes from consumer agencies throughout the U.S. highlighted the Hillsborough County Consumer Protection Agency’s struggle with fighting “one of the highest rates of insurance fraud” in the U.S.

In northeast Florida, nearly all of the counties fall below the statewide average cost—except for Duval County. Why? Part of it is likely due to Jacksonville, another major city in Florida. Our analysis showed that quotes in Duval County were an average of 5 percent above the cost of the average policy statewide.

Policyholders facing greater risk of becoming victim to an insurance-related crime will likely live and drive around a city, urban and/or metro area where such crimes, whether it’s a staged accident or faked crash injury, are more prevalent. When facing greater risk of pricier claims, insurers will, in turn, charge more for coverage.

You can find a wide range of quotes even within a city/metro area. According to our analysis, the lowest quote in Miami-Dade County was $4,145 while the highest was $21,578. In Alchua County, the lowest quote was $2,458 and the highest was $9,115.

Territorial Rules Differ Between States, Insurers

To further complicate matters, each insurer has its own rating system. So there’s no exact way to pin down how location plays into the calculation of rates, but having a general idea can save you money in the long run.

In Florida, insurers face only one location-related restriction in their pricing: no one ZIP code can be used alone as a rating territory. But even without using a single ZIP code in pricing models, our county-by-county breakdown shows that location still has a major role in how much a policyholder pays.

In California, pricing models must rely on “geographic areas” that are at least 20 square miles. ZIP codes within those areas are grouped into “bands” with similar average claims frequency and severity, according to an analysis of territorial insurance laws by the Connecticut Office of Legislative Research (OLR).

Connecticut’s rating models are based on 18 pre-determined “rating territories,” which play into a weighting system of statewide and more localized claims backgrounds. Considering statewide figures “helps temper the rates in urban areas” that are relatively higher, according to the OLR.

But whatever name you give it—location, territory, geographic area—where you drive and keep your car means a lot in how much you pay for coverage.