Have you ever taken a closer look at the bulky envelope your auto insurance company sends you every time your policy renews? That packet of paper holds the details of your auto insurance policy and can be a lifesaver when you need to know those details to file a claim. If you haven’t taken the chance to review your policy on paper, make time to do so. Anyone who doesn’t have an auto insurance policy yet but is wanting to know more, read further as we explain the different parts of the auto insurance policy explanation packet. We’ll break down the parts and explain their purpose.

Have you ever taken a closer look at the bulky envelope your auto insurance company sends you every time your policy renews? That packet of paper holds the details of your auto insurance policy and can be a lifesaver when you need to know those details to file a claim. If you haven’t taken the chance to review your policy on paper, make time to do so. Anyone who doesn’t have an auto insurance policy yet but is wanting to know more, read further as we explain the different parts of the auto insurance policy explanation packet. We’ll break down the parts and explain their purpose.

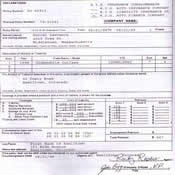

The first part of your insurance policy packet is the declarations page. This page lists the important factors of your policy, starting with information identifying the auto insurance company and the policyholder. The name of your auto insurance company should be listed, as well as their contact information should you ever need to get in touch with them. Not only will you find your insurer’s information, but you should be able to see your information as well. Your name, phone number, and address should be listed on the declarations page, showing you as the policyholder. Along with this information about you, your policy number should be listed too. Your policy number, which can be all numbers or a mix of numbers and letters, is the way the insurance company identifies you first on their records. This way, if two policyholders happen to have the same name, their information will not get confused and will stay private.

The next part of the declarations page names the types of coverage you purchased and the amount you purchased. Usually a detailed explanation of the coverage isn’t provided here, but you can ask your agent for the specific information or search our site for general information regarding that coverage. These may include bodily injury liability, property damage liability, and uninsured or underinsured motorist liability.

In reference to the cost of each coverage, that amount is the maximum amount, or limit, the auto insurance company will pay for an accident. It is these coverage amounts purchased that help decide how much your premium is going to be. One way to lower your premium is by lowering the limits of coverage you purchased. However, this gives you less protection and you may find yourself in the predicament of not having enough if an accident happens.

The deductible amount is also listed on the declarations page. This is the amount you agreed to pay to the auto insurance company when you file a claim to them. Deductible amounts are usually offered in the amounts of $100, $250, $500 and $1,000, but other options may be available from your insurer. The purpose of deductibles is, one, to show the insurer that you have experienced a loss that exceeds a certain amount, and two, to reduce the final cost the insurer is going to pay. To keep your premiums low, sign up for a deductible that is high, such as $500 or better yet, $1,000. Because you agree to pay more for your deductible, the auto insurance company lowers your premium cost.

Also on the declarations page is the policy period, stating exactly when the policy begins and the date it ends. Pay particular attention to the end date so you can renew your policy and not have a lapse in coverage. Almost all auto insurance companies offer to automatically renew your policy for you on that date so you will always have continuous coverage. If for some reason you want to cancel your policy (moving out of state, wanting a new insurer), you can cancel on that date before your policy renews, or you can cancel it at any time as long as your next insurance policy can begin on your cancel date.

After the declarations page is a section with actual contract language that will go over the details of the coverage you purchased, and the rights and responsibilities of the auto insurance company and of you, the policyholder. It’s common knowledge that auto insurance companies have the responsibility to pay for the coverage that was bought by the policyholder, but they also have rights that protect them from any scandalous activity, like insurance fraud. It is good to know both your rights as the policyholder and the insurer’s rights so any disreputable activity can be reported. Of course, if this “contract language” is too difficult to understand, review it with a lawyer or call the insurance company and have them explain the details.

There may be an additional section in your packet, known as the endorsement section. An endorsement is something that changes the policy, and those changes must be written somewhere in the contractual agreement. These endorsements expand the policyholder’s coverage in the policy and are made by the auto insurance company. Remember that any time you make a change to your policy, you are affecting the premium cost and your rates will change too. This section is beneficial since you may need to make a change to your policy before your policy ends and renews. For instance, your teenager may begin to drive in the middle of the policy and he needs to be added to the policy at this time. A quick call to your insurance agent or company and they will construct an endorsement that changes your policy, allowing your teenager to be covered. Your new rates will begin then as well.

One last thing included in your policy packet is your proof of insurance card. These cards will show any law enforcement officer that you are carrying auto insurance, which is a law in most states. They should be kept in your glove box or other safe place in your car so you always have them available.

Knowing the particulars of your auto insurance policy will make sure that you have the exact type of coverage you want, instead of wishfully thinking you have options when in reality you don’t. Go through the policy packet every time you get it to make sure nothing has been missed, and if you have any questions, contact your auto insurance company for better clarification.