Every day, people decide they've had it with the cars they're driving (even if they are running fine and are relatively new) and resolve to buy something else. That decision can cost them considerable amounts of money.

Maybe they're like the tall St. Louis man we met not long ago. He had bought a Honda Civic but decided after a few months that it was just too small for him. The dealership was happy to take the Civic as a trade-in toward the larger Honda Accord, but it had some bad news: The owner was "upside down" in the Civic, owing $4,000 more than it was worth.

What It Means To Be "Upside Down"

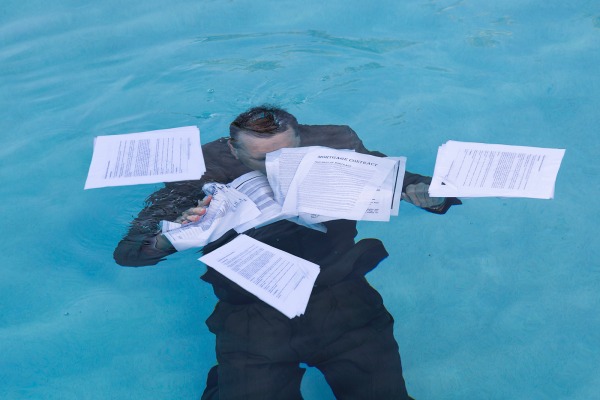

"Upside down," "under water" and "negative equity" are interchangeable terms for a bad situation: All three mean that the car owner owes more on the vehicle than it's worth.

Let's say you have $15,000 worth of car payments to make on a car that is only worth about $10,000 (usually thanks to new car depreciation). That means you are $5,000 upside down. If, at that moment, you decide to trade in this car and buy a new one, you will have to pay the price of the new car plus the $5,000 you owe on the current car. Your monthly payments will be much higher because you're rolling over what you owe on your old car to the loan on your new one. Now you're really upside down.

It's a common dilemma. In 2015, 30 percent of car sales that had a trade-in were ones in which the owner still owed money on the vehicle, according to Edmunds.com data. The average amount of negative equity: $4,502.

How People Go "Under Water"

In the case of the St. Louis man, an extra test-drive might have prevented him from buying a car that literally didn't fit him, but other situations aren't as open and shut. Maybe you bought a coupe and now need a sedan to transport kids. Perhaps you bought a car that turned out to be more expensive than you could afford and you couldn't keep up with the monthly payments. Or maybe you just got tired of your car after a couple years. The circumstances may differ, but they put you in the same place: You're trying to get out of a car loan before it is paid off.

New cars go through their steepest depreciation in the first couple years of ownership. You'll owe more than the car is worth if you didn't make a large enough down payment — and most people don't. You might also be upside down if you rolled over a balance from a prior car loan.

If the negative equity you carry to the new car is minimal, then it won't be a terrible burden to bear. But it gets to be very painful when you carry negative equity over from car to car. The debt gets bigger and bigger, like a snowball rolling downhill.

How To Get Above Water

There is no silver bullet that will magically get rid of the negative equity. Your options are to deal with the situation either now or later. Here's how:

Stick With Your Current Car: You probably don't want to hear this, but the best strategy for getting above water is to scrap plans for a new car and stay with the one you have. You'll need to keep it at least until you reach a break-even point in the loan. Ideally, you'll want the value of the car to outweigh the amount you owe.

If you've brought a balance over from a previous car, you might never break even at all, at which point paying off the loan outright is your only recourse.

To get above water faster, try to make larger payments, if your budget will allow it. You might also consider refinancing the loan. This will lower the interest rate and bring down the monthly payments.

Roll the Balance Into a New Car Loan: This is the most common method that people use because it doesn't cost them anything out of pocket. The dealership will roll over what you owe on the trade-in vehicle into the new car's loan. It offers a convenient way to buy the new car, but your monthly payments will be higher. You will not only be paying interest on the new loan, but also on the balance of what you owe on the previous car.

Incentives could reduce that balance, or even potentially erase the negative equity. For example, if a person was $1,500 upside down on the trade-in car and wanted to buy a new car that had a $2,500 rebate, he or she could erase the negative equity and still have $1,000 for a down payment on the new car.

Note, however, that cars with heavy incentives tend to have lower resale value for at least three years, according to Edmunds pricing analysts. This means you will be upside down for a longer period of time. In other words, it will take more time for this car to be available as a free-and-clear trade-in.

Roll the Debt Into a New Car Lease: An alternate strategy is to lease the car rather than finance the purchase of it. The approach is largely the same: You trade in your car that has an outstanding loan balance. The balance is factored into the lease. You will still deal with higher than normal monthly payments, but at the end of the lease (typically three years), you are no longer upside down. If you qualify for a lease special with a low monthly payment, such as the $199 or less deals that have become increasingly common , it can soften the blow of carrying along the negative equity. You won't have to worry about any of the resale value issues since the car goes back to the dealership at the end of the lease.

But therein lies the rub. You don't have a car to use as a trade-in toward your next purchase. Your options are to lease again or finance your next new or used car purchase.

A Loan Payoff Idea — With a Hitch

You might be wondering about this scenario: Assume you have set aside some money for a down payment on a new car. Could you use that cash to pay off the loan on the "under water" car and buy the new car without a down payment? We ran the numbers and found that while you could save a little money with this approach, it has its own problems, particularly if your credit is shaky. In that case, a lender might not be willing to approve a car loan without a down payment. Check with your lender and the car dealership to see what scenario works best for you.

Deal With Life's Curveballs

Sometimes you can't avoid the life changes that affect your vehicle needs. But if you understand how negative equity works and how to manage it, you will have the best chance of getting above water and right-side up.