I recently gave a seminar on car buying, and a man in the audience asked a question that came back to haunt me.

"I was negotiating for a car, and the salesman suddenly showed me the invoice," he said. "Should I be suspicious?"

It took me a minute to understand the question. In recent years, experts have been telling consumers to demand to see the invoice. So why was this guy asking if he should be suspicious when the invoice was volunteered?

Finally, I figured it out. "Oh, you mean, if he volunteers the invoice, is that a danger signal?"

"Yeah, right," he said.

Then I gave an answer I wish I could take back: "No, that's not a red flag. Salespeople are just responding to the consumer. They know you won't consider it a good deal unless you see the invoice. They're trying to show you they are open and honest."

Let me say that I sincerely hope this was the case. But it might not be. And I want to take this opportunity to expand on a trend I think is developing in the car-buying arena.

First, bear in mind that the profit margin on a new car is much slimmer than you would assume. While other products are marked up by as much as 50 percent, cars only have a profit margin in the single digits — typically from 2 to 6 percent. This means that a car sold at 4 percent over an invoice of $20,000 would make $800 for the dealer on the actual sale (more on this later). If the salesperson makes a 10 percent commission on the profit, that's just $80 for him or her.

According to the National Automobile Dealers Association (NADA), new car sales generate only 25 percent of the profit for a dealership. Another 29 percent comes from the sales of used cars. But most of a dealership's money, 46 percent, is made on service and the sale of parts.

So you have to understand that when you walk into a dealership, you are being viewed as a profit package.

And on top of all those things, you will hopefully buy your next car at the same dealership in the not too distant future.

What does all this have to do with reading the invoice? I wanted you to have an understanding of the big picture before we move on to the fine points, as well as see why dealerships will do fine in the long run even if the profit they make on new cars is very low.

During a recent discussion with my accountant, he asked me, "If profit is low, then why are the owners of dealerships all multimillionaires?" Well, that's because the thirst for profitability at a dealership is insatiable. To achieve profit, in an era of increasing consumer education, the game changes. Which brings me to my point: If you negotiate in relation to the invoice — say, $500 over invoice — make sure the dealership isn't building up profit in another area of the deal.

Here's an example. A friend of mine was shopping for a Dodge Grand Caravan. He showed me a copy of the invoice and said the Internet department of a local dealership said that he could have the car for the invoice price. "Great," I said. I went to the friend's house the next day and saw a shiny new Dodge Grand Caravan parked there with the dealer promotional plates on the rear.

It's a touchy thing to discuss a car deal once it's been inked, since it's a foregone conclusion at that point, so I proceeded cautiously.

"Are you happy with the deal you got?" I asked.

"Well, we got the van at invoice but..." Uh-oh. Here it comes, I thought. "When we went to sign the contracts, we found out they had included $800 for an alarm system. We bought it anyway since we were getting such a good deal — and we really wanted the van."

Here are nice, easy-going people, who were put in an awkward position. "Over a barrel" is more like it. They come in thinking they did their homework, got the best deal possible, then they get nailed for an alarm system they didn't want. The alarm system probably didn't cost the dealership more than $100.

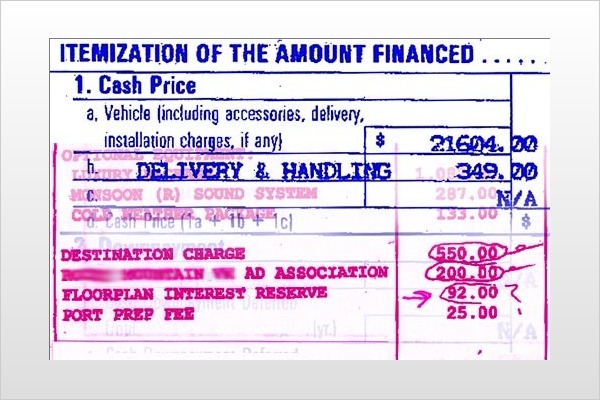

In another case, a friend of mine was told by a dealer that he could buy a hard-to-find Volkswagen for $500 over invoice. When the contract arrived, the dealers had added a $349 fee for "D&H" or "delivery and handling" charge. This charge was added to the contract despite the fact that the invoice already contained the following charges: $550 for the destination charge, $200 ad fee, $92 for "floor plan interest reserve" and a $25 "port prep fee."

After checking with industry sources, it is Edmunds' position that fees on the manufacturer's invoice are not negotiable. However, if duplicate fees (such as the "D&H" fee in this VW contract) are written into the contract by the dealer, these additional charges can be challenged.

A friend of mine who worked in the banking industry reviewed the VW contract and honed in on the "D&H" fee. "In the banking industry this is what we called a 'junk fee.' You should just go back to the dealer, smile and say, 'Nice try.'"

So, let's go back to the question I got in the car-buying seminar. If the salesperson readily shows you the invoice, declaring, "And we'll sell you this car for only $500 over invoice," keep this in mind: The profit might be built back into the equation in other places.

If you are shopping over the Internet, or over the phone (highly recommended), ask these questions:

Also ask to have the contract faxed to you ahead of time. . In the case of my VW-buying friend, the extra charge added by the dealer built the price back up to TMV. My friend would have been much happier to have paid TMV up front, rather than being deceived into paying it with bogus charges and sleight of hand.