In the mid-'80s, the $3,990 Yugo captured the American imagination. The lightweight subcompact built in what was then Yugoslavia sold more than 120,000 units before quality problems and the U.S. economic boom — plus the fact that high winds helped whip a Yugo off the Mackinac Bridge in 1989 — tanked sales in the early '90s and reduced the brand to a punch line.

Is automotive history ready to repeat itself? A new wave of inexpensive small cars from China, the Czech Republic and elsewhere may be landing on American shores over the next few years. But it's far from certain that American consumers will be interested.

"The U.S. market is different in a lot of ways than it was in the Yugo era," said Lonnie Miller, director of industry analysis for R.L. Polk, a Southfield, Michigan-based firm that tracks the auto market. "It may not work out the same way."

There's Always Room at the Bottom

The case is obvious for a strong U.S. market for $8,000-$10,000 subcompacts, even from dubious countries of origin. Gasoline at more than $3 a gallon has more American consumers making fuel economy their top priority. Even the tiniest, stripped-down American-, German-, Japanese- or Korean-built subcompact these days commands a sticker price of at least $12,000-$13,000, with the notable exceptions of the Chevrolet Aveo and Kia Rio, whose base models sell for around $11,400.

Many automakers and entrepreneurs are jockeying to fill the perceived gap. Chrysler, for example, finalized a deal under which China-based Chery will jointly develop, manufacture and sell small cars abroad. Eventually, Chrysler may sell the cars in the United States under the Chery brand.

"Chery can provide us a lower-cost platform and infrastructure for global expansion," said Steve Bartoli, Chrysler's vice president of global product planning and marketing. "But strategically it's also a good place to be for the U.S. market, because you never know what's going to happen with fuel prices and the supply of oil. We have to be there."

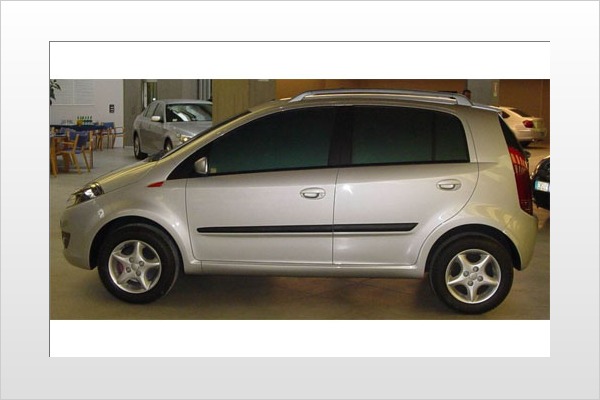

Geely is another Chinese automaker positioning itself for a push into the U.S.. In fact, consumers on Trinidad and Tobago, Aruba and certain other Caribbean islands already can buy and drive $11,500 Geely-made subcompacts that are being distributed there by an Isuzu dealer in nearby San Juan, Puerto Rico. They're outfitted with automatic transmissions, air-conditioning, and power windows and door locks.

"We're going full-speed ahead with plans for Puerto Rico and the United States mainland, too, beginning in late 2009 with 2010 model-year vehicles," said Hector Estrada, president of Emerito Estrada Rivera Isuzu de Puerto Rico. "Geely cars already have passed the majority of U.S. crash tests and safety standards, and now the engineers are working hard on meeting EPA regulations."

Eastern European imports also may get back into the mix as they did in Yugo days. Volkswagen now owns Skoda, a Czech Republic automaker that flirted with a U.S.-market entry in the '90s. And industry rumors have it that VW may put its own badge on Skoda-built models to occupy a lower-priced segment than the Jetta and New Beetle.

American Car Buyers May Have Moved On

But reasons abound to believe that, when and if the cheap imports finally arrive, Americans might not be there to greet them.

For one thing, during the recent surge in gasoline prices, U.S. consumers haven't been reflexively clamoring to buy econobox gas-sippers as they did during the fuel crises of the early and late '70s. Sales in this "B segment" of the industry haven't increased much even lately, stuck for the long term at around a quarter-million units a year out of a total U.S. automotive market of 16 million to 17 million sales annually.

One primary factor in this trend is that, unlike a generation ago, small cars almost never are primary vehicles in American households anymore. "The family fleet has gotten bigger, and as it has, small cars have become less important," said Art Spinella, president of CNW Marketing, an automotive-research firm in Bandon, Oregon.

And while Chrysler may someday want to import Chery cars as a way to counter rivals' moves in the B-car segment, Chrysler's Bartoli didn't cast that as a likelihood. "Unless American car buyers are forced into it," he said, "I don't think they're going to make this segment a strong piece of the U.S. auto industry again." In fact, Bartoli noted, the main way that consumers have reacted to higher gasoline prices has been to shift to smaller and more fuel-efficient engines within the same size category rather than to get smaller vehicles.

And if Americans want smaller cars, used vehicles are a much better proposition these days than they used to be. Nearly all vehicles sold in the American market are much better built than even a few years ago. The proliferation of certified used cars sold by dealers with factory warranties has helped as well.

"Cheap alone is not enough to sell new cars in this market anymore," said Bernard Swiecki, senior project manager at the Center for Automotive Research, at the University of Michigan.

Higher Standards Mean Higher Hurdles

Another obstacle for inexpensive Chinese and other small imports is that Americans' standards for vehicle acceptability are even higher than those that flunked the Yugo in the '90s. Leasing, for example, has helped make more Americans accustomed to relatively rich equipment levels even in small cars.

"The U.S. auto market tends to be selfish about needs, and there is a small minority of auto buyers who want to give up comfort just for the sake of having basic transportation on four wheels," said Polk's Miller. What's more, Chinese-built vehicles are demonstrating that they may not be up to minimum American quality standards. In one of the few crash tests to date of a Chinese-made vehicle outside China, a Chery-made sedan recently badly failed a crash test in Russia, which is China's biggest auto-export market. Recent news of shoddy quality and lurking dangers in Chinese-made products ranging from toothpaste to Mattel toys has stirred similar concerns among consumers worldwide.

That could be a huge trouble sign for Chrysler's new partner. "Both Chinese automakers and their U.S. partners," said Swiecki, "realize that the United States is now a buying environment that isn't going to be tolerant, where consumers aren't going to be willing to wait a generation of vehicles until everything is perfected."

Dale Buss has covered the auto industry for more than 20 years. He is based near Detroit.