To help you get the best deal when you buy your next car, you should understand how the salespeople will "work the numbers" on a four-square worksheet as they negotiate. The worksheet — which covers everything from auto loan payments to trade-in price — helps the salespeople view the total profit to the dealership while reviewing the separate elements of the deal.

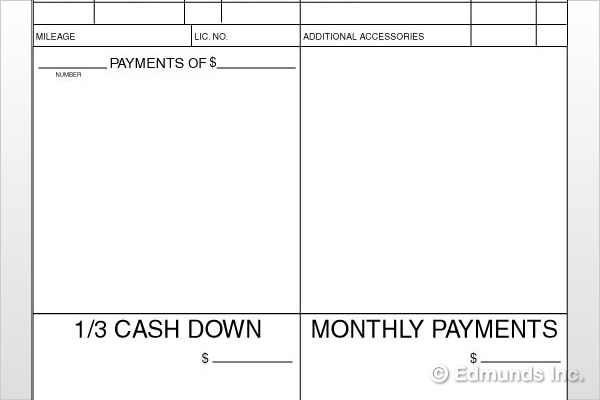

As the name suggests, the sheet is divided into four large squares:

As you can see, these four separate pieces are interconnected. If, for example, a customer is concerned about receiving the full value of her trade-in, the dealer will inflate the amount of the trade-in and then raise the monthly payment on the auto loan regarding the new car. Now the customer is satisfied, but the dealer is still making the same total amount of profit.

Avoid Being Trapped by the Four-squareFirst of all, try to keep the deal as simple as possible. Consider selling your old car rather than trading it in. With a little effort, you could save a lot of money. Or secure outside auto financing before you go to the dealership. Taking these advance steps will allow you to negotiate the price of the car only rather than playing the monthly payment game.

If you want to trade in your current vehicle and become a monthly payment buyer (sometimes dealers can offer attractively low interest rates), work the numbers yourself before you go to the dealership. Decide what your maximum down payment and monthly auto loan payment should be. Then, decide on your lowest figure for the trade-in. Look at the Edmunds.com TMV® to find out what a fair selling price for the car should be. Now, write all these figures down so that you can control the whole deal to limit your expenses in the same way the dealer tries to maximize his profit.