Here are the terms you are most likely to encounter when you finance a car through a bank or at a car dealership.

APR: This stands for Annual Percentage Rate. This is related to, but slightly different than, the interest rate. This is the interest rate times the number of periods in the year. If an interest rate is 4 percent quarterly, the APR would be 16 percent. The APR supposedly makes it easier to compare different loans because it always translates the loan to a yearly figure. But some experts caution putting too much stock into the APR because hidden fees can raise or lower this figure.

Balance: The balance of the loan is the amount remaining to be paid. Each time you make a payment, the balance is reduced.

Credit: This word is loosely used in a number of ways. In the financial world, it means the ability to borrow money. If someone says, "She has strong credit," it means a lending institution would gladly lend her money. A company might be given a "line of credit."

DMV Fees: When buying a car at a dealership, you have to register it and pay for license plates before you can drive it away. These various fees are referred to as DMV fees. These costs might also be called title and license fees. These fees are a percentage of the purchase price of the car and will slowly decrease as the car ages and loses its value.

Down Payment: When someone buys a car, and finances it through the dealership, they are usually required to make a down payment of cash. This payment is credited against the balance of the loan. In other words, if you are buying a $20,000 car, and putting down $3,000, the loan will be for $17,000. People wishing to reduce their monthly payments can do this by increasing the down payment.

Finance and Insurance Office: When you buy a car at a dealership, you negotiate with the salesperson. Once a deal is reached, you are escorted into the Finance and Insurance Office where the contracts are drawn up and signed. This is sometimes called F&I.

Finance: If a car is "financed," it means you are borrowing money -- either as a loan or a lease -- to pay for it as you drive it. Instead of financing a car, you could buy it outright with cash. When you buy a car with cash, it immediately becomes yours. When you finance the car, the bank owns it, and holds the title, until you've made the last payment.

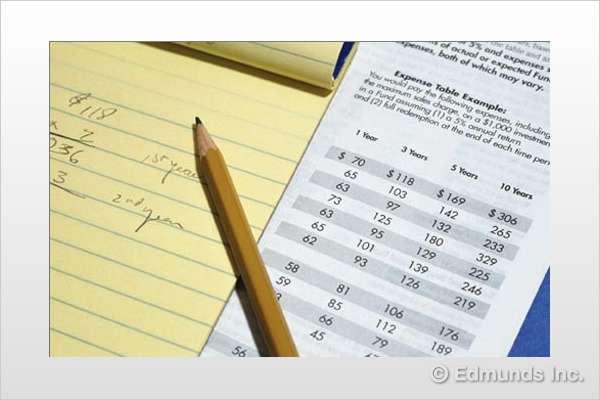

Four-Square Worksheet: A standard form, used at many dealerships, to help the salesperson keep track of the four elements of a deal as he negotiates with the customer. The squares allow him to jot down offers and counter offers for the trade-in, the price of the car, the down payment and monthly payments.

Interest Rate: When money is borrowed, the lending institution, often a bank, charges a small fee for this service. Interest rates are charged as a percent of the amount loaned.

Lease: If you lease something, such as a car, you don't actually own it. You pay a monthly fee to use the car. At the end of the lease, you return the car and owe nothing more (assuming it is returned in good condition and with the agreed-upon mileage).

Lending Institution: Any company that loans money is a lending institution. It's sometimes thought that only banks loan money, but this isn't true. Auto loans can be arranged by credit unions, banks or the auto manufacturer itself.

Sales Tax: When someone buys an item, they are charged a percentage of the purchase as state sales tax. The actual percentage varies widely from one state to the next and, often, within the state. The sales tax is often made up of a state tax and a local tax. These two are combined for one grand total. On small items, the sales tax doesn't seem significant. But when purchasing a car, it can be a large factor that affects the total cost of ownership.

Term: This is the length of the loan, usually stated in months. Common terms for car loans and leases are 36, 48 or 60 months.

Title: A title is a legal document providing specific information about the vehicle and stating who owns it. If you borrow money from a bank to get a car, the title will be held by the bank until you make all the agreed-upon payments.