"Come on into my office and I'll work up some numbers for you," salespeople often tell prospective car buyers. The buyer then meekly follows the salesperson into a tight little office to be bombarded with numbers and prices, most of which are much higher than expected.

But smart shoppers know that you shouldn't throw yourself at the mercy of a car salesperson. On Web sites like Edmunds.com, you can find most of the pertinent car-buying figures. Still, how do you crunch the numbers like a salesperson would? How can you find out what your loan or lease payment will be?

To help you get the answers to these questions, we introduce the Edmunds.com suite of Financial Calculators. Sure, Edmunds.com has offered various calculators for several years, but this new product centralizes all the number-crunching a car buyer needs to do. It also minimizes the need for entering information. Once you have chosen a car and a financial payment option, Edmunds.com automatically fills in the appropriate prices, fees, taxes and other figures, allowing you to manipulate the data in a variety of ways.

Now, from a single tool, you can find answers to questions like these:

Introduction Page

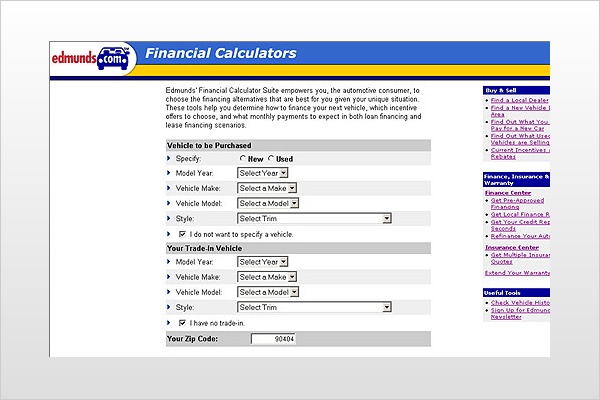

Although the calculators can be accessed from different areas of the Edmunds Web site, most consumers will want to start at the Calculators. Here, you decide whether you are buying a new or used car, and then choose the year, make, model and style of the car you are considering. After you have selected a vehicle, Edmunds pre-populates certain data fields (such as vehicle price, sales tax and registration fees) — eliminating work for you. (Note: If you click the box marked "I do not want to specify a vehicle" you can obtain generic information about car payments and interest rates.)

In the next section, you provide similar information regarding your trade-in vehicle, if you have one.

After that, you are ready to compare the different financing choices available to you. The information you have provided will automatically be inserted into each of the four calculators that are linked at the bottom of the page:

As you move between these different calculators using the tabs at the top of the screen, your latest figures are automatically carried to the next calculator.

Basic Loan Calculator

This calculator is used to determine what your monthly payment will be for the car you wish to buy. All you have to do is select a vehicle, and the Basic Loan Calculator will automatically fill in the purchase price, sales tax, associated fees (title, registration and other costs) and a finance rate with a 36-month term. After making these choices the calculator will present the monthly payment amount.

If you want to change any of the data fields to customize it (say the interest rate or term length), the calculator will automatically recalculate the numbers and present a new monthly payment. If you had already specified your trade-in on the Introduction Page, that trade-in value will also be automatically inserted based on the Edmunds.com True Market Value® for this vehicle.

Last, you will want to input the down payment and any applicable customer rebates. The trade-in, down payment and consumer rebate are subtracted from the total purchase price of the car to give you the total you will need to borrow and the monthly payments based on the term length and interest rate.

Decision: Low APR vs. Cash Back

When financing a new car, you might have to decide which incentive you want to take: low-interest financing or a cash rebate. It isn't always readily apparent which incentive will be the most financially beneficial. That's when you need to use this "decision" calculator.

If you've already entered your data into the system, most of the figures should already be in place when you open this calculator. However, you can change the interest rate, the length of the loan in months and the amount of the customer cash rebate in order to customize for your situation. Then, look at the bottom of the calculator and you will see that it either recommends "Take the Cash!" or "Take the Financing!" The amount saved by using the recommended method is also displayed.

Basic Lease

Some consumers have already made up their minds to lease their cars, and all they want to know is the monthly payment. For these people, the Basic Lease Calculator will be very useful. If a car was chosen from the Introduction Page, the relevant vehicle information will already be present. Additionally, the most common terms and finance rates have already been inserted, so an approximate lease payment can be generated.

The Basic Lease Calculator is very flexible and will allow you to see lease payments based on other interest rates and lease terms. The longer you lease, the lower your payment. Remember that, in general, the longer the lease term, the higher your interest rate will be.

Decision: Buy vs. Lease

Many people have trouble deciding whether to lease a new car or to buy it. This calculator will help them make the right decision based on their individual situation and the interest rates and incentives that are available.

Again, those who began at the Introduction Page will find most of the appropriate numbers should already be in place. However, you can choose to compare a three-year lease with, say, a four-year car loan. After determining the length of the lease and loan, the Buy vs. Lease Calculator crunches the numbers and clearly presents the smarter decision at the bottom of the calculator. It also shows how much savings is realized by choosing the preferred financing method.

Conclusion

These calculators can be used before you go shopping, to see if the cost of a certain car fits into your budget, or after you get a quote from a local dealer to make sure the numbers add up. However, remember that the calculators are only as good as the information that you put into them. Carefully check all of the figures to make sure they are accurate for your situation.

Finally, if you're not sure of the specific numbers in your situation, use the calculators as a general guideline. Then plug in more accurate figures as they become available. Controlling the numbers will give you confidence, since you'll know you're getting the best deal possible the next time you shop for a new car.