Every year, the National Association of Insurance Commissioners (NAIC) releases a report of annual auto insurance data that includes the average expenditure and average premium for a policy in each state. The list is often cited by the media, regulators, lobbyists, and politicians to show either how unnecessarily high or how reasonably low the average price of car insurance is in their state compared with the rest of the country.

Every year, the National Association of Insurance Commissioners (NAIC) releases a report of annual auto insurance data that includes the average expenditure and average premium for a policy in each state. The list is often cited by the media, regulators, lobbyists, and politicians to show either how unnecessarily high or how reasonably low the average price of car insurance is in their state compared with the rest of the country.

When you hear someone citing the NAIC statistics, it’s important to distinguish whether they’re talking about the average expenditure or combined average premium, because there’s a significant difference in how they’re calculated and what they represent.

First of all, both of the NAIC’s state averages are based on the prices of liability, comprehensive, and collision coverage. Liability coverage pays for other people’s injuries and property damages that were caused by the policyholder, while comprehensive and collision pay for repairs to the car insured under the policy. Liability coverage is required by law in every state; comp and collision aren’t required in any state, but the majority of people buy them.

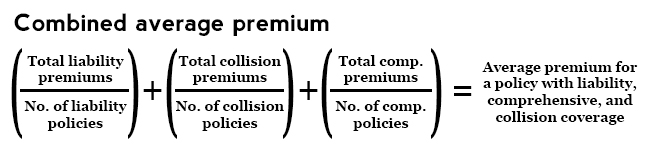

Combined average premium: For the combined average premium, the NAIC takes the total amount of liability premiums paid by drivers in the state and divides it by the total number of annual policies, which gives them the average annual premium for liability coverage. It then does the same thing for collision coverage and then for comprehensive coverage, dividing the total premiums for that coverage type by the total number of policies for that coverage type, which gives them the average premium for each type. The NAIC then adds up the three to get the average cost for a policy that includes liability, comprehensive, and collision coverage.

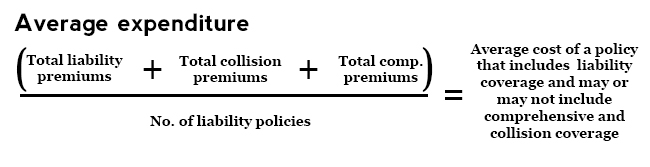

Average expenditure: For the average expenditure, the NAIC takes the total amount of premiums for liability, collision, and comprehensive coverage that was paid by drivers and adds them up. The total premiums are then divided by the total number of liability policies to give the average amount that drivers paid for coverage overall.

While both of these statistics represent similar things, the key difference is that the average expenditure is more influenced by consumer habits than the combined average premium.

In the end, the combined average premium indicates how much a policy with all three coverage types (liability, comp, and collision) would cost on average. The average expenditure, on the other hand, looks at what the average person paid for car insurance, regardless of whether they ended up purchasing comprehensive and/or collision coverage.

This distinction is important because it explains some of the discrepancies that crop up between the two statistics.

For example, in 2010 Mississippi had a combined average premium that was higher than Washington’s, but Washington paradoxically had a higher average expenditure than Mississippi. The reason for this: consumer habits. Though Mississippi had higher average rates for comp and collision coverage, Mississippians bought those optional coverages at a much lower rate than Washington drivers. About 75 percent of Washington drivers bought collision, and about 81 percent of them bought comprehensive. In Mississippi, only 67 percent bought collision and only 69 percent bought comprehensive.

So, in the end, Mississippi had a higher combined average premium because comp and collision coverage are more expensive there than in Washington. But Mississippi’s average expenditure ended up being lower because fewer people in that state ended up buying those coverages.

What this means for you is that if you want to compare rates between states using the NAIC averages, you need to know if you’re trying to see the average price for a policy with liability, comp, and collision, or if you’re trying to see the average amount that the typical consumer paid for car insurance. If you want the former, use the combined average premium; if you want the latter, use the average expenditure.

There are other factors to consider when making comparisons between states. For instance, both statistics from the NAIC are still influenced by consumer habits to an extent because consumers in some states tend to buy higher levels of liability coverage than in others. Regardless of whether that’s a result of the state’s minimum coverage limits or consumer habits, it will increase the total premiums that they pay and will end up influencing their state averages.