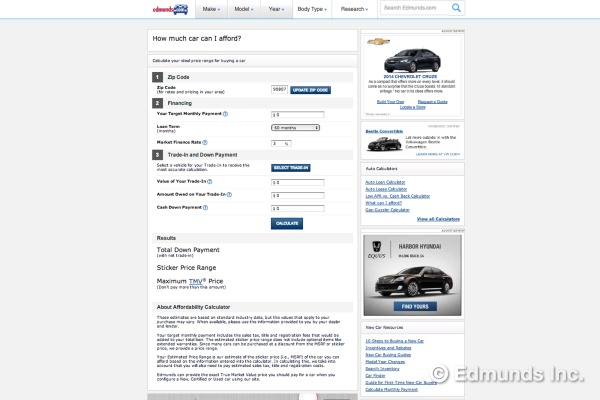

People shop for cars with their hearts as well as their heads, and that can be a little dangerous. A car that sets your pulse racing might also be the one that would bust your budget. That's where Edmunds.com's calculator "How Much Car Can I Afford?" comes in handy. It can prevent you from getting in over your head when you buy a new car. All you do is enter some basic information and this tool can help you arrive at an estimated price range in which you should shop. It will even suggest some cars that would fit your budget.

Below is a breakdown of what goes into the calculation.

ZIP Code: It's used to calculate taxes and your finance rate; both vary regionally. Shoppers often forget to budget for these extra expenses, which are quite significant.

Your Target Monthly Payment: This is what you can afford to pay each month. Unlike car ads, this number takes into consideration tax, title and registration fees that would be included as part of your total loan. Edmunds recommends that these payments not exceed 20 percent of your monthly after-tax income. This figure doesn't include gas, insurance or maintenance, which you can factor via our True Cost to Own® (TCO) calculator.

Loan Term: We recommend financing for no more than 60 months. A shorter loan will make your payments higher. Longer car loan terms may lower your monthly payments a bit, but they don't justify the jump in the cumulative interest you'll pay over time. Furthermore, the older the car is, with more wear and tear, the harder it is psychologically to meet the payments because of your perception of its value.

Market Finance Rate: Our calculator defaults to 6.99 percent. Fortunately, interest rates have been dropping recently, and you can enter other rates here. (For a list of rates related to credit scores, read "Car Financing in a Recovering Economy.") If you have a pre-approved car loan from your credit union or bank, input the rate here. Then, when you talk to various dealerships, you can compare the financing they're offering to the loan you already have.

Value of Your Trade-In: This step assumes that if you have a car, you are trading it in to the dealer who is selling you the new car. If you were to sell your old car to a private party, though, you would probably get more money to put toward reducing your new loan amount. Use the "Appraise a Used Car" calculator to know your car's value in both scenarios.

Amount Owed on Your Trade-In: If you still owe money on your trade-in, enter that here. The difference between the trade-in value and the actual payoff on the trade-in is treated as a credit or debit against the new vehicle. To determine what you owe, you can call the number on your monthly bill, or you can multiply your payment amount by the number of installments you have left before the end of your contract.

Cash Down Payment: Try to put down as much as you can afford. Shoot for at least 20 percent. This reduces the size of your loan and thus your monthly payment. Also, a 20 percent down payment equals the first year's depreciation. This means you will never be "upside down" on your loan, owing more than the value of the car.

These are the results you'll get:

Total Down Payment (with net trade-in): This is the total of your cash down payment plus your trade-in.

Sticker Price Range: This is the range of sticker prices in which you should shop. Since most cars can be purchased at a discount from the sticker price (which is also known as the manufacturer's suggested retail price [MSRP]), we provide a price range. Finance a car whose sticker price is at or under the top number, and you should be within the range of what you can afford each month.

Maximum TMV Price: Don't pay more than this amount.

At the bottom of the calculator, you'll see a list of cars that fall in your price range. You can then look in further detail at the ones that interest you, knowing that you can afford any one of them.

Play around with the car affordability calculator by changing the inputs to see how they affect one another. This is actually a lot of fun and a great way to learn about financing. The answers you get might be humbling, and you may decide you'd be better off financially if you choose a car in a lower trim level, a less expensive model or even a used car. If you follow these guidelines, you'll end up not only with a car you can afford, but also the peace of mind that you've made a smart financial decision.